Introduction

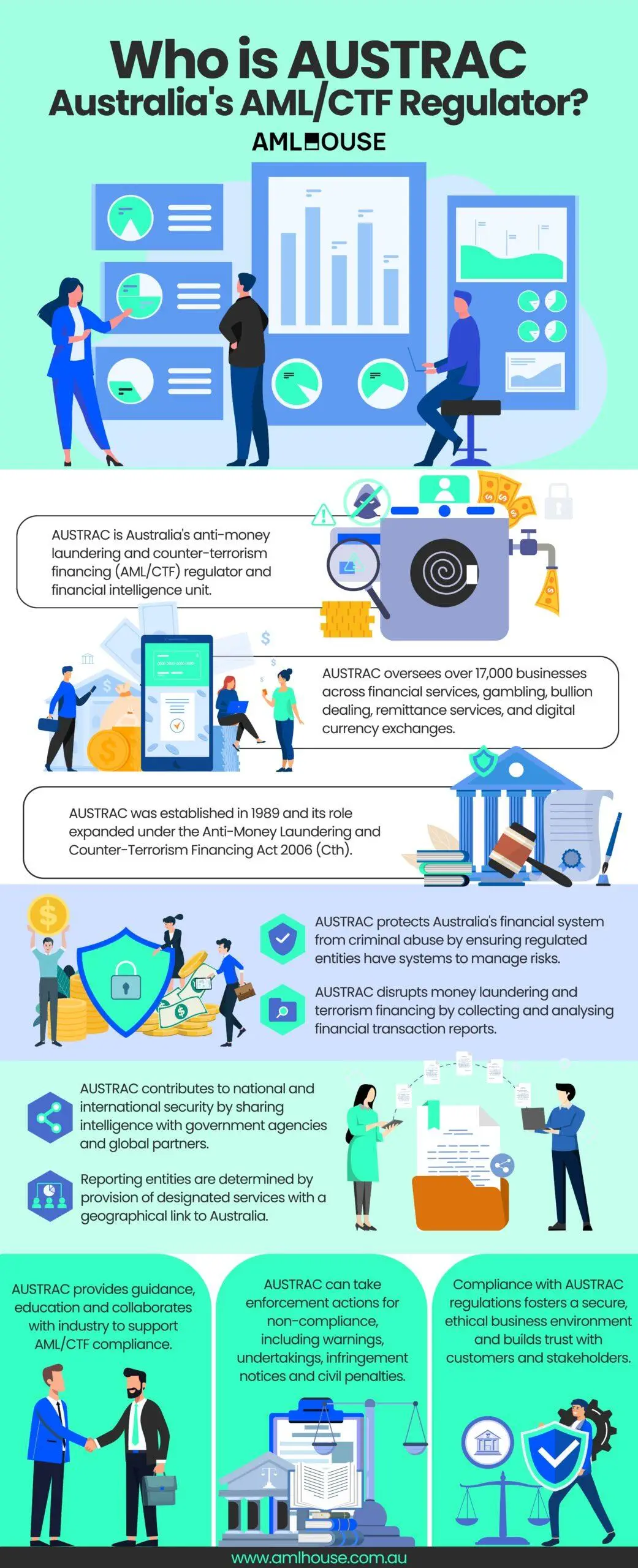

In Australia, the Australian Transaction Reports and Analysis Centre (AUSTRAC) is the nation’s primary agency for anti-money laundering and counter-terrorism financing (AML/CTF). As both the regulator and financial intelligence unit, it oversees reporting entities—ranging from various businesses to organisations providing designated financial services—to mitigate the risks associated with money laundering and terrorism financing.

This guide offers a comprehensive overview of AUSTRAC’s key functions and responsibilities. It explains how the agency combats financial crime, including serious and organised crime. By understanding AUSTRAC’s mandate, businesses can better navigate their obligations, ensure compliance, and help build resilience against criminal activities in the Australian financial system.

What is the Australian Transaction Reports and Analysis Centre (AUSTRAC)?

AUSTRAC’s Core Identity and Dual Role

The Australian Transaction Reports and Analysis Centre (AUSTRAC), serves as Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regulator and its financial intelligence unit. This dual role is crucial for building resilience within the Australian financial system. By utilising financial intelligence and regulatory frameworks, AUSTRAC effectively detects and disrupts money laundering, terrorism financing activities, and other serious financial crimes.

As the AML/CTF regulator, AUSTRAC oversees more than 17,000 businesses. These reporting entities operate across various sectors, including:

- Financial services

- Gambling

- Bullion dealing

- Remittance services

- Digital currency exchange providers

AUSTRAC ensures that these regulated entities comply with their obligations. These obligations are designed to establish systems and controls that effectively manage risks, thereby protecting both the businesses themselves and the wider Australian community from criminal exploitation.

Historical Context and Legislative Foundation

AUSTRAC was established in 1989 under the Financial Transaction Reports Act 1988, initially known as the Cash Transaction Reports Agency. Over time, AUSTRAC’s role has significantly evolved to address emerging financial threats.

The introduction of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act 2006 (Cth)) further expanded AUSTRAC’s responsibilities and scope. This legislative change reflects the growing recognition of the importance of combating financial crime and terrorism financing. Consequently, AUSTRAC’s enhanced role under the 2006 Act underscores its critical position within Australia’s national security framework and its ongoing efforts to combat financial crime.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Why AUSTRAC Regulates AML/CTF

Protecting the Financial System from Criminal Abuse

AUSTRAC’s primary objective is to protect the Australian financial system from criminal exploitation. As Australia’s anti-money laundering and counter-terrorism financing regulator, AUSTRAC plays a crucial role in ensuring the integrity of financial operations within the country. By regulating over 17,000 businesses, AUSTRAC aims to build resilience within the financial system, safeguarding it from various forms of criminal abuse.

Criminals often seek to exploit vulnerabilities within the financial sector to disguise illicit funds derived from criminal acts. These illicit funds are frequently linked to serious crimes, including:

- Drug trafficking

- Fraud

- Tax evasion

- Terrorism

To combat these threats, AUSTRAC ensures that regulated entities, known as reporting entities, establish and maintain robust systems and controls. These measures are designed to manage risks and protect both the businesses themselves and the wider Australian community from the detrimental impacts of financial crime.

Disrupting Money Laundering and Terrorism Financing

As Australia’s financial intelligence unit, AUSTRAC is dedicated to disrupting money laundering and terrorism financing activities. AUSTRAC employs financial intelligence and regulatory frameworks to:

- Detect illicit financial flows

- Deter criminal activities

- Disrupt money laundering and terrorism financing

This proactive approach is essential in combating serious and organised crime, which often relies on these financial activities to thrive.

To achieve this disruption, AUSTRAC collects and analyses financial transaction reports and information from reporting entities. This data is then transformed into actionable financial intelligence, which is crucial for:

- Law enforcement investigations

- National security operations

By working closely with industry, government, and law enforcement partners, AUSTRAC delivers tangible outcomes that directly contribute to the fight against financial crime.

Contributing to National and International Security

AUSTRAC’s role extends beyond domestic financial system protection to encompass contributions to both national and international security. As part of Australia’s National Intelligence Community, AUSTRAC collaborates with various government agencies and law enforcement bodies at both state and federal levels. This collaboration supports whole-of-government priorities in:

- Combating financial crime

- Enhancing national security

Internationally, AUSTRAC actively engages in efforts to combat transnational financial crime. To counter money laundering and terrorism financing across borders, AUSTRAC shares intelligence with other financial intelligence units and regulators worldwide. This international cooperation is vital for:

- Addressing global threats

- Upholding international standards in the fight against financial crime

Australia is a member of the Financial Action Task Force (FATF), and AUSTRAC plays a key role in ensuring the nation adheres to these international benchmarks.

Who AUSTRAC Regulates

Reporting Entities and Designated Services

AUSTRAC regulates specific business activities identified as carrying a risk of money laundering and terrorism financing. These activities are termed designated services. Any individual, business, or organisation that provides one or more designated services with a geographical link to Australia is considered a reporting entity.

It is important to note that being a reporting entity is determined by the provision of designated services, rather than the type of business. Consequently, various types of businesses and organisations typically act as reporting entities because they commonly provide these designated services. These include:

- Financial institutions: This category encompasses banks, credit unions, and building societies.

- Remittance service providers: Businesses that offer money transfer services fall under this classification.

- Digital currency exchange providers: Entities that exchange digital currencies, such as cryptocurrency for traditional money or vice versa, are included.

- Bullion dealers: Businesses dealing in precious metals like gold, silver, platinum, or palladium also qualify as reporting entities.

- Gambling sector businesses: This includes casinos and betting agencies.

Geographical Link Requirement for Australian Businesses

For businesses to have obligations under Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regulations, the designated services they provide must have a geographical connection to Australia. This geographical link requirement ensures that AML/CTF obligations are appropriately applied to businesses operating within or connected to Australia.

A geographical link to Australia is established if at least one of the following conditions is met:

- Permanent establishment in Australia: The designated service is provided through a permanent establishment located in Australia.

- Australian residency with foreign operations: The reporting entity is an Australian resident, and the designated service is provided through a permanent establishment in a foreign country.

- Subsidiary of an Australian company: The reporting entity is a subsidiary of an Australian resident company, and the designated service is provided through a permanent establishment in a foreign country.

Key Functions and Responsibilities of AUSTRAC

Financial Intelligence Gathering and Analysis

As Australia’s financial intelligence unit, AUSTRAC plays a critical role in gathering and analysing financial information. This process is essential for generating actionable intelligence that supports law enforcement and national security investigations. AUSTRAC collects a wide range of financial transaction reports from reporting entities, including:

- Threshold Transaction Reports (TTRs): For cash transactions of $10,000 or more.

- Suspicious Matter Reports (SMRs): For transactions that appear unusual or potentially linked to illicit activities.

- International Funds Transfer Instructions (IFTIs): For transfers of funds into or out of Australia.

AUSTRAC’s specialist financial intelligence analysts meticulously examine this data. They use sophisticated techniques to identify patterns, trends, and links that may indicate money laundering, terrorism financing, or other serious financial crimes. This analysis is crucial for detecting and disrupting criminal networks and understanding how criminals may be exploiting the Australian financial system.

Furthermore, AUSTRAC disseminates this intelligence to various partners, including law enforcement, national security agencies, and government bodies. This collaboration ensures that the insights derived from financial intelligence inform and enhance operational responses to financial crime.

Regulatory Supervision and Compliance Monitoring

AUSTRAC serves as Australia’s anti-money laundering and counter-terrorism financing regulator, overseeing over 17,000 reporting entities across various sectors of the Australian financial system. These sectors include:

- Financial Services

- Gambling

- Bullion Dealing

- Remittance Services

- Digital Currency Exchange Providers

In its regulatory role, AUSTRAC ensures that these entities comply with their obligations under the AML/CTF Act 2006 (Cth). These obligations are designed to mitigate and manage the risks of money laundering and terrorism financing.

To achieve compliance, AUSTRAC conducts various supervisory activities, such as assessments, audits, and reviews. These activities monitor adherence to AML/CTF obligations and provide feedback to reporting entities. By ensuring that businesses have robust systems and controls in place, AUSTRAC helps protect both the businesses themselves and the broader Australian community from the detrimental impacts of financial crime.

Guidance, Education, and Industry Collaboration

AUSTRAC provides extensive guidance and education to support reporting entities in meeting their AML/CTF obligations. This support is crucial for building a strong and resilient AML/CTF framework across Australia. The resources offered by AUSTRAC include:

- Training Programs: Designed to help businesses understand their AML/CTF responsibilities.

- Guidance Materials: Covering various aspects of compliance, such as developing and implementing AML/CTF programs, conducting customer due diligence, and identifying and reporting suspicious matters.

In addition to providing resources, AUSTRAC actively fosters collaboration with the private sector. A key initiative in this area is the Fintel Alliance, an AUSTRAC-led partnership between government and private sector organisations. The Fintel Alliance works to enhance the resilience of the Australian financial sector and improve the detection and disruption of financial crime through collaborative efforts and information sharing. This united approach recognises that effectively combating financial crime requires cooperation between regulators and the businesses they regulate.

Enforcement Actions and Ensuring Compliance

To maintain the integrity of the regulatory framework and deter non-compliance, AUSTRAC is empowered to take enforcement actions against entities that fail to adhere to AML/CTF laws. These enforcement actions are critical for ensuring that all regulated businesses comply with their obligations. AUSTRAC’s enforcement powers include:

- Issuing Warnings and Remedial Directions: To businesses not meeting their obligations.

- Accepting Enforceable Undertakings: Formal agreements where businesses commit to rectifying identified compliance issues.

- Issuing Infringement Notices: For certain breaches of the AML/CTF Act, which can result in financial penalties.

- Applying to the Federal Court for Civil Penalty Orders: Leading to substantial fines for serious breaches.

In cases of severe non-compliance or suspected criminal conduct, AUSTRAC can also refer matters to law enforcement agencies for criminal investigation and potential prosecution. A prominent example of AUSTRAC’s commitment to enforcement is the case against the Commonwealth Bank, which resulted in significant penalties for failing to comply with AML/CTF regulations. This case underscores AUSTRAC’s dedication to ensuring compliance within the Australian financial sector.

Contributing to a Secure and Ethical Business Environment

Compliance with AML/CTF regulations, overseen by AUSTRAC, fosters a more secure and ethical business environment. By adhering to these regulations, businesses actively contribute to the integrity of the Australian financial system. This commitment to compliance helps to build trust and confidence among customers, stakeholders, and the broader community. Operating ethically and responsibly is increasingly important for businesses seeking to maintain a positive reputation and long-term sustainability.

Furthermore, a strong AML/CTF framework encourages businesses to adopt best practices in risk management and corporate governance. Implementing robust systems and controls not only helps to prevent financial crime but also enhances operational efficiency and resilience. Businesses that prioritise AML/CTF compliance demonstrate a commitment to ethical conduct, which can enhance their brand reputation and attract customers who value integrity and security.

Key benefits of AML/CTF compliance include:

- Enhanced Trust and Confidence: Building stronger relationships with customers and stakeholders.

- Improved Risk Management: Reducing the likelihood of financial crimes affecting the business.

- Operational Efficiency: Streamlining processes to comply with regulatory requirements effectively.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Consequences of Non-Compliance and Financial Penalties

Non-compliance with AUSTRAC regulations can lead to significant financial penalties for businesses. A prime example of this is the case against the Commonwealth Bank. This case serves as a stark reminder of the serious repercussions for businesses that fail to meet their anti-money laundering and counter-terrorism financing (AML/CTF) obligations. The Commonwealth Bank faced substantial financial penalties due to its non-compliance, highlighting the potential financial risks businesses face if they do not adhere to AUSTRAC’s regulatory framework.

AUSTRAC’s commitment to enforcing AML/CTF regulations is evident in this enforcement action. The potential financial repercussions for non-compliant businesses include:

- Substantial Financial Penalties: As demonstrated by the Commonwealth Bank case.

- Legal Actions: AUSTRAC can take legal steps against businesses that fail to comply.

- Reputational Damage: Non-compliance can harm a business’s reputation, affecting customer trust and stakeholder confidence.

Conclusion

Australian Transaction Reports and Analysis Centre (AUSTRAC) is a key Australian agency that functions as both the anti-money laundering and counter-terrorism financing regulator and the country’s financial intelligence unit. This dual role is vital for enhancing the resilience of Australia’s financial system and protecting it from criminal exploitation. By monitoring reporting entities and providing essential financial intelligence to law enforcement and national security agencies, AUSTRAC plays a pivotal role in detecting and disrupting money laundering and terrorism financing activities, ultimately safeguarding the broader Australian community from serious and organised crime.

For businesses operating within the Australian financial sector, understanding and adhering to AML/CTF obligations is not merely a matter of compliance, but a fundamental aspect of contributing to a secure and ethical business environment. If you require assistance in navigating the complexities of AML/CTF compliance and ensuring your business meets its regulatory obligations, please contact us at AML House to explore how our specialised knowledge can help you comply and contribute to the integrity of the Australian financial system.

Frequently Asked Questions

AUSTRAC regulates businesses in financial services, gambling, bullion dealing, remittance services, and digital currency exchange. These sectors are designated as high risk for money laundering and terrorism financing.

Designated services are business activities with a higher risk of money laundering or terrorism financing. Check AUSTRAC’s website for a general overview, or Section 6 of the AML/CTF Act 2006 for a complete list.

The geographical link requirement means reporting entities have AML/CTF obligations only for designated services connected to Australia. This applies if your business has a permanent establishment in Australia, you’re an Australian resident providing designated services through a permanent establishment overseas, or you’re a subsidiary of an Australian company providing services through a permanent establishment abroad.

Key obligations include a compliant AML/CTF program, customer due diligence, and reporting to AUSTRAC. This includes systems to mitigate risks, reporting suspicious matters, threshold transactions, and international funds transfers.

Reporting entities submit suspicious matter reports (SMRs), threshold transaction reports (TTRs) for cash transactions of $10,000 or more, and international funds transfer instructions (IFTIs). These reports are crucial for AUSTRAC’s financial intelligence gathering.

Non-compliance can lead to warnings, remedial directions, enforceable undertakings, infringement notices, and civil penalties. AUSTRAC may refer serious cases to law enforcement.

AUSTRAC uses financial intelligence to support law enforcement and national security investigations. They analyse reports to detect and disrupt financial crimes.

Businesses can find resources on AUSTRAC’s website, including guidance materials, industry-specific guidance, and training programs. These resources help businesses develop and implement AML/CTF programs.

Yes, Australia is a member of the FATF, the international body setting global AML/CTF standards. AUSTRAC ensures Australia adheres to these standards.