Introduction

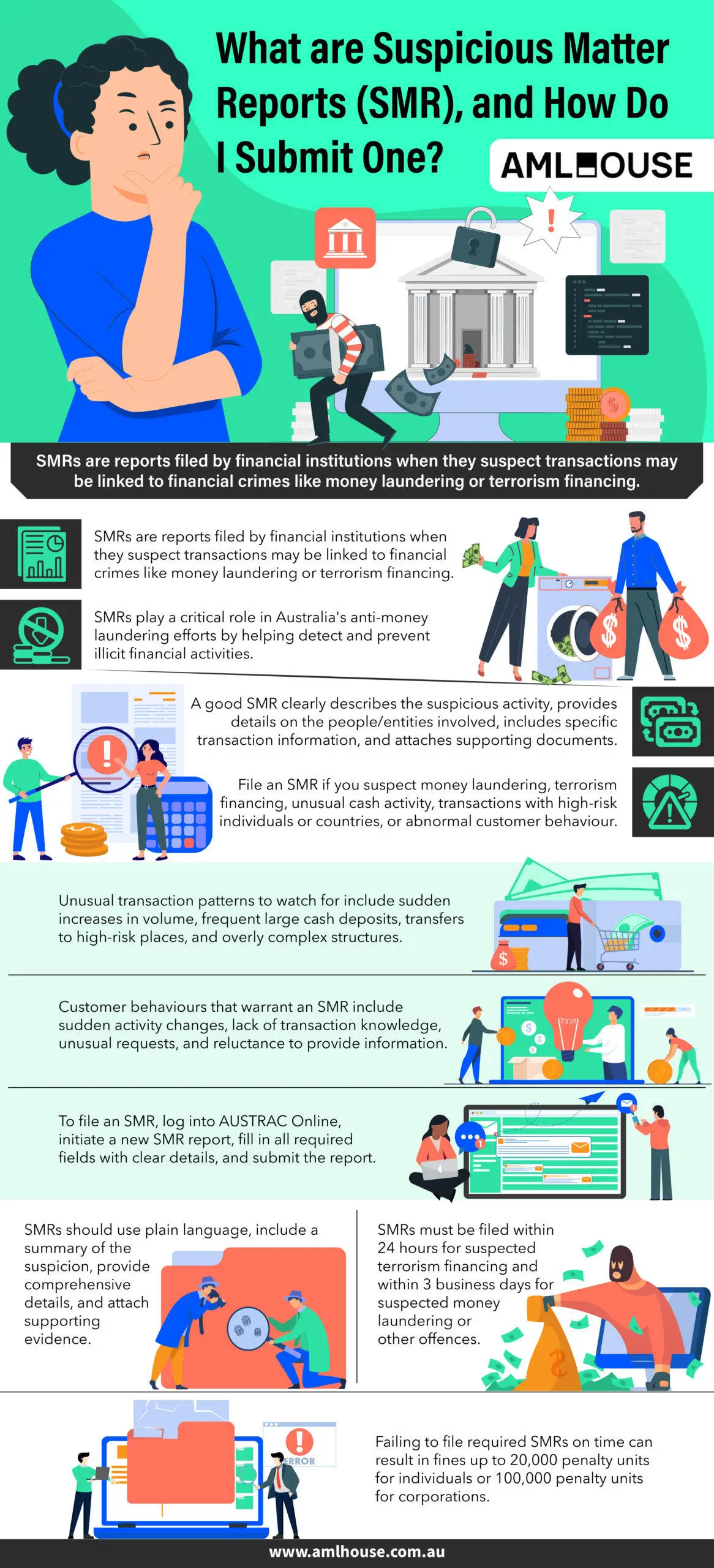

Suspicious Matter Reports (SMRs) are crucial components in Australia’s strategy to prevent and detect financial crimes, including money laundering and terrorism financing. These reports are filed by financial institutions and designated service providers when they identify or suspect transactions that may be linked to illicit activities.

Properly filing an SMR is essential for organisations to meet their legal obligations and contribute to maintaining the integrity of Australia’s financial system. This guide offers an overview of SMRs, highlighting their importance in anti-money laundering (AML) efforts and outlining the fundamental steps required to submit an SMR effectively.

Understanding Suspicious Matter Reports

The Role of SMRs in Anti-Money Laundering

SMRs are integral to anti-money laundering efforts. They enable financial institutions to report transactions or activities that are suspected to be linked to money laundering, terrorism financing, or other illicit activities to regulatory authorities such as the Australian Transaction Reports and Analysis Centre (AUSTRAC). By facilitating the exchange of information between financial institutions and regulatory bodies, SMRs enhance the detection and prevention of financial crimes, supporting AML initiatives.

Key Elements of an SMR

A comprehensive SMR should include detailed and accurate information to effectively aid in the detection and prevention of financial crimes. The key elements of an SMR are:

• Description of the Suspicious Activity: Clearly outline the nature of the suspicious transaction or activity, including any unusual patterns or anomalies observed.

• Details of the Person or Entity Involved: Provide identifying information about the individual or organisation involved, such as full name, address, Australian Business Number (ABN), occupation, and any aliases.

• Transaction Information: Include specifics about the transactions that raised suspicion, such as dates, amounts, types of transactions, and involved parties.

• Supporting Documentation: Attach any documents or electronic data that were used to verify identity or substantiate the suspicion, such as identification documents, photographs, or transaction records.

Having these elements well-documented ensures that the SMR provides a clear and complete picture of the suspicious matter, enabling regulatory bodies to take appropriate action. Accurate and detailed reporting enhances the effectiveness of SMRs in combating financial crimes, making them a vital tool for AML compliance.

When and Why to File an SMR

SMR is a critical component of Australia’s AML/CTF (anti-money laundering and counter-terrorism financing) framework. It ensures that activities or transactions that could potentially support money laundering or terrorism financing are promptly reported to the relevant authorities. Below are the key scenarios and reasons for filing an SMR.

1. Suspicion of Money Laundering and Terrorism Financing

When there is any indication that a transaction or series of transactions may be disguising illicit funds or supporting terrorist activities, an SMR must be filed. Examples include:

- Unusual Cash Activity: Large cash deposits or transfers, especially when they lack a clear business rationale.

- High-Risk Patterns: Transactions that exhibit layering tactics, such as multiple wire transfers between various accounts and across different countries.

- Terrorism Financing Concerns: Cases involving financing activities related to terrorism require even more stringent scrutiny and must be reported within 24 hours.

These measures help deter criminal activities by ensuring suspicious transactions are investigated promptly.

2. Transactions Involving High-Risk Individuals or Jurisdictions

Certain transactions are inherently riskier and require additional vigilance:

- High-Risk Individuals:

- Transactions involving Politically Exposed Persons (PEPs), who are more susceptible to corruption or bribery, require enhanced due diligence.

- Any unusual activity in accounts tied to PEPs should trigger an SMR.

- High-Risk Jurisdictions:

- Transactions involving funds being sent to or received from countries identified as high-risk by regulatory bodies or those with weak AML controls.

- Activities with entities in jurisdictions known for high levels of corruption should also be reported.

By monitoring and reporting on these high-risk transactions, financial institutions and reporting entities help to mitigate risks associated with international financial crimes, thereby maintaining the overall integrity of Australia’s financial system.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Identifying Suspicious Activity

Unusual Transaction Patterns

Unusual transaction patterns are key indicators of potential illicit activities. These may include large cash deposits, frequent transfers, or inconsistent transaction volumes that deviate from a customer’s typical behaviour.

Some common signs to watch for are:

- Sudden Increase in Transaction Volume: A significant rise in the number or size of transactions without a clear business reason.

- Frequent Large Cash Deposits: Regular deposits of large sums that are inconsistent with the customer’s known income or business activities.

- Transfers to High-Risk Jurisdictions: Moving funds to or from countries known for high levels of financial crime or lacking robust AML controls.

- Complex Transaction Structures: Multiple transfers through various accounts or financial institutions to obscure the origin of funds.

Identifying these patterns helps in early detection of money laundering and other financial crimes, enabling timely reporting to regulatory authorities.

Abnormal Customer Behaviour

Abnormal customer behaviour can also signal potential financial misconduct. Behaviours such as sudden changes in account activity or a lack of knowledge about one’s own business operations warrant further scrutiny.

Key behaviours to monitor include:

- Sudden Changes in Account Activity: Unexpected spikes or drops in transaction volumes that do not align with the customer’s usual patterns.

- Lack of Knowledge About Transactions: Customers who appear confused or uninformed about the origin or purpose of their transactions.

- Unusual Requests or Instructions: Requests for unusual or complex transaction instructions that may be designed to evade detection.

- Reluctance to Provide Information: Hesitation or refusal to supply necessary information during due diligence processes.

Monitoring these behaviours allows financial institutions to conduct enhanced due diligence, ensuring that suspicious activities are promptly identified and reported.

How to File an SMR

Steps to File an SMR

- Log in to AUSTRAC Online:

- Access the system via the transaction reporting menu.

- Initiate the SMR Process:

- Click the “+” sign next to the transaction reporting menu.

- Select “create amend reports” and then choose “SMR”.

- Complete and Submit the Report:

- Fill in all required fields and follow the detailed instructions provided within AUSTRAC Online.

- Submit the report once all information has been entered.

Key Aspects to Remember When Completing the SMR

- Grounds for Suspicion:

- Explain clearly and concisely why the customer’s behaviour is suspicious.

- Use plain English and structure the information in a clear, logical format.

- Include as many details as possible to support your suspicion, outlining all potential indicators or red flags.

- Information to Include:

- Business or Organisation Details:

- Provide information about the business or organisation involved.

- Include details about the suspicious matter, the person/organisation it relates to, and any transactions involved.

- Individual Details:

- For individuals, include:

- Full name, address, telephone number, date of birth, country of citizenship, occupation, and type of business activity.

- ABN, email address, any other name they operate under, and a detailed description of identity verification documents.

- If the identity is unknown:

- Include a description of the person, any available video footage or photographs, and any known address or email details.

- For individuals, include:

- Potential Victims:

- If the customer might be a victim of a crime, do not list them as the subject of the SMR.

- Instead, include their information in the section designated for any other party related to the suspicious matter.

- Business or Organisation Details:

- Legal Considerations:

- Note that while the SMR is not admissible as evidence in court, it can be used as part of criminal proceedings for certain Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) offences.

- Overall Quality of the SMR:

- A good SMR will logically outline all reasons for suspicion, include known or suspected crime details, and be presented in a clear and readable format.

By following these steps and keeping the key aspects in mind, reporting entities can ensure that their SMRs are comprehensive and compliant with AUSTRAC requirements.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Best Practices for Effective SMRs

Clear and Concise Reporting

Effective SMRs must be clear and concise to ensure that the information is easily understood and actionable. Use plain English and avoid unnecessary jargon to communicate the suspicion effectively. Organise the report logically, presenting information in a structured manner that guides the reader through the key points without confusion. A well-structured SMR helps AUSTRAC and other regulatory bodies quickly assess the nature of the suspicious activity and take appropriate action.

Additionally, it’s essential to summarise the reasons for suspicion succinctly at the beginning of the report. This overview provides a quick reference for reviewers and highlights the most critical aspects of the suspicious matter.

Providing Detailed Information

Including detailed information in your SMR is crucial for enabling effective investigation and action. Ensure that all relevant aspects of the suspicious matter are thoroughly documented. This includes comprehensive details about the person or entity involved, such as full names, addresses, occupation, and any aliases.

Provide specific transaction information, including dates, amounts, types of transactions, and the parties involved. This level of detail helps in identifying patterns and connections that may not be immediately apparent. Additionally, attach any supporting documentation, such as identification documents, photographs, or transaction records, to substantiate the suspicion.

By offering complete and accurate information, you enhance the effectiveness of the SMR, making it a valuable tool in the detection and prevention of financial crimes.

Deadlines and Penalties

Deadlines for Submission

SMRs must be submitted within specific timeframes to ensure timely action by AUSTRAC. Adhering to these deadlines is essential for effective anti-money laundering and counter-terrorism financing efforts.

- Terrorism Financing: SMRs related to terrorism financing must be filed within 24 hours of forming a suspicion.

- Other Offences: For suspicions related to money laundering or other offences, SMRs must be submitted within 3 business days.

Ensuring adherence to these deadlines is crucial for compliance with AML/CTF reporting obligations and aids in the swift detection and prevention of financial crimes.

Penalties for Non-Compliance

Failing to submit SMRs within the specified deadlines or neglecting to file them when required can result in significant legal consequences. The penalties for non-compliance include:

- For Individuals: Fines of up to 20,000 penalty units in the Federal Court of Australia.

- For Corporations: Fines may reach up to 100,000 penalty units if the entity is a body corporate.

These penalties underscore the importance of timely and accurate reporting to maintaining the integrity of Australia’s financial system and to fulfil legal obligations under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth).

Conclusion

Understanding the significance of SMRs is essential for professionals in various industries to comply with Australia’s anti-money laundering regulations. By accurately identifying and promptly filing SMRs, you play a critical role in protecting the financial system from money laundering, terrorism financing, and other illicit activities.

To ensure your organisation meets its regulatory obligations and maintains the integrity of its financial operations, contact our experienced team today. Our experts are ready to assist you in navigating the complexities of SMR filings, providing proven solutions tailored to your specific needs.

Frequently Asked Questions

An SMR is a formal document submitted to AUSTRAC by financial institutions and designated service providers when they suspect or have reasonable grounds to believe that a transaction or activity is associated with money laundering, terrorism financing, or other illicit activities.

Designated service providers, including financial institutions and certain non-financial businesses, are required to file an SMR if they have reasonable grounds to suspect that a transaction is linked to money laundering, terrorism financing, or other specified offences.

“Reasonable grounds for suspicion” means that, after considering all available information and circumstances, a reasonable person would conclude that there is a relevant suspicion requiring an SMR. To determine this, conduct enhanced due diligence checks when you notice unusual customer behaviour or transaction patterns.

An SMR must include comprehensive details about the suspicious matter, the person or organisation involved, and any transactions related to the suspicion. Specifically, it should contain a description of the suspicious activity, details of the person or entity involved, transaction information, and any supporting documentation.

To submit an SMR online, access your AUSTRAC Online account and navigate to the transaction reporting menu. Follow the prompts to create and submit your SMR, ensuring all required fields are accurately filled out.

After submitting an SMR, AUSTRAC may use the information to further investigate the suspicious activities. They may request additional information or documentation from you to clarify details in the report.

Yes, if you suspect that your customer is the victim of a crime, you should submit an SMR. Include details about the victim and the circumstances that led to the suspicion to aid AUSTRAC in tracking and preventing illicit fund flows.

An effective SMR is clear, concise, and includes detailed information to aid AUSTRAC in their analysis. It should provide a precise description of the suspicious activity, comprehensive details about the persons and transactions involved, and be submitted within required deadlines.

Failing to submit an SMR when required can result in significant penalties under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth). Individuals may face fines of up to 20,000 penalty units in the Federal Court of Australia, while corporations can be fined up to 100,000 penalty units.