Introduction

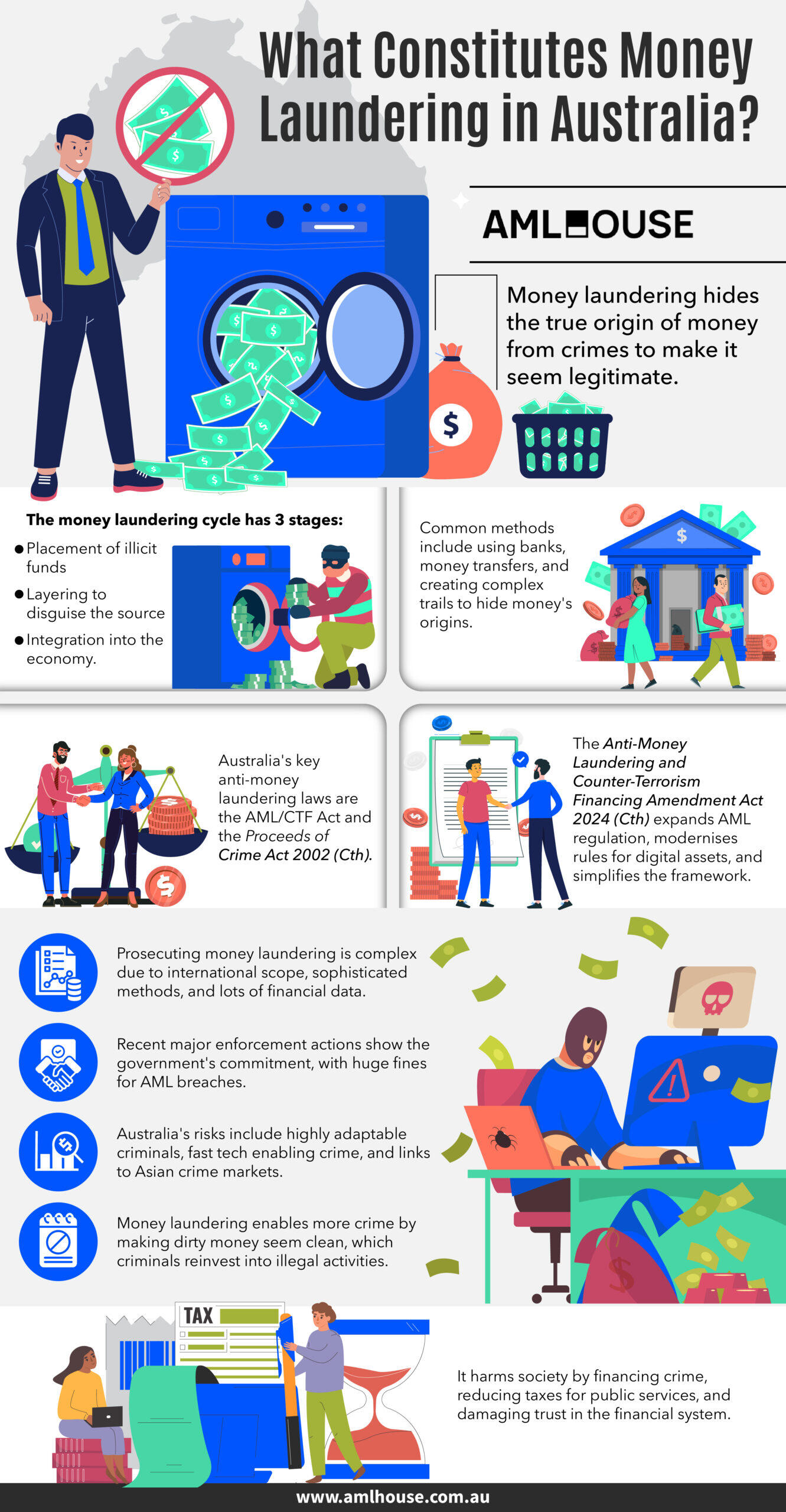

Money laundering involves hiding or disguising the true origin and ownership of funds obtained through criminal activities, serving as a critical component of organised crime and undermining Australia’s financial system and economy. Understanding the mechanisms and implications of money laundering is vital for safeguarding the Australian community and ensuring economic stability.

Recent legislative advancements, notably the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth), have been introduced to enhance Australia’s capabilities in combating money laundering. These reforms aim to expand the AML/CTF (Anti-Money Laundering and Counter-Terrorism Financing) regime to include additional high-risk services, modernise regulations concerning digital assets, and streamline the overall framework to better prevent and detect financial crimes.

Understanding Money Laundering

Definition of Money Laundering

Money laundering involves hiding, disguising, or legitimising the true origin and ownership of money used in or derived from committing crimes. It serves as a crucial mechanism for organised crime groups to integrate illicit funds into the formal economy, thereby making them appear legitimate.

Main Elements of Money Laundering

Money laundering encompasses two main elements:

- Legitimisation of Illicit Funds: This process involves transforming illegally obtained money to give it the appearance of being legally earned. Techniques include complex financial transactions, using multiple bank accounts, and investing in legitimate businesses to obscure the money’s criminal origins.

- Utilisation of Funds for Further Criminal Activity: Once the funds appear legitimate, they are used to supporting or expand criminal operations. This can involve reinvesting in more illicit activities, purchasing high-value assets, or funding terrorism, thereby perpetuating the cycle of crime and enhancing the financial stability of criminal organisations.

The impact of money laundering on Australia’s economy and society is profound. It undermines the integrity of the financial system, diminishes tax revenues, and weakens government control over the economy. Additionally, it facilitates the growth of serious and organised crime, leading to increased social harm and erosion of public trust in financial institutions.

The Money Laundering Cycle in Australia

Placement

Placement is the first stage of the money laundering cycle, where illegal funds or assets are introduced into the financial system. This initial step involves placing illicit money into the formal economy to make it appear legitimate.

Common placement techniques include:

- Structuring Deposits: Breaking up large amounts of cash into smaller, less suspicious transactions and depositing them into multiple bank accounts to avoid detection.

- Purchasing Assets: Using cash to buy high-value assets such as real estate, vehicles, or luxury goods, which can later be sold to integrate the funds into the economy.

- Using Cash-Based Businesses: Investing in businesses that handle substantial amounts of cash, such as restaurants or casinos, to mix illicit funds with legitimate revenue.

Layering

Layering involves disguising the origin of illicit funds through a series of complex transactions. This stage aims to obscure the money trail and make it difficult for authorities to trace the funds back to their criminal source.

Common layering techniques include:

- Multiple Bank Accounts: Transferring money between various accounts across different banks and jurisdictions to create a convoluted trail.

- Use of Intermediaries: Engaging professionals such as accountants, lawyers, or financial advisors to facilitate transactions and further obscure the money trail.

- Corporate Structures: Utilising corporations, trusts, or shell companies to conduct transactions that make tracing the origin of funds challenging.

Integration

Integration is the final stage of the money laundering cycle, where laundered funds are reintroduced into the economy as legitimate wealth. At this stage, the illicit money appears integrated within the financial system, allowing criminals to use it freely without suspicion.

Common integration methods include:

- Legitimate Investments: Investing in legitimate businesses or financial markets to give the appearance of lawful income.

- Purchasing High-Value Assets: Acquiring properties, luxury items, or other high-value assets that can be easily sold or used to support further criminal activities.

- Establishing Legitimate Businesses: Creating or acquiring businesses that can justify large cash flows and provide cover for illicit funds.

Common Money Laundering Methods in Australia

Banking System and Money Transfer Services

Money launderers often utilise the banking system and money transfer services to disguise illicit funds. These financial institutions provide a platform for depositing large sums of cash or transferring money across different accounts and jurisdictions. Criminals take advantage of these services to legitimise their funds, making it difficult for authorities to trace the money back to its illegal sources. Additionally, they continually develop new schemes to circumvent anti-money laundering (AML) measures, enhancing the complexity of detection and prevention efforts.

Creating Complex Money Trails

Creating complex money trails is a prevalent method in money laundering, involving multiple transactions to obscure the origin of funds. This strategy includes moving money through various accounts, using multiple financial institutions, and interspersing legitimate transactions to break the link between the illicit source and the final destination. By generating intricate pathways, launderers make it challenging for investigators to identify the original source of the money. Techniques such as structuring deposits, also known as “smurfing,” where large amounts are broken into smaller, less detectable sums, are commonly employed to facilitate the placement of funds into the financial system without raising suspicion.

Legal Framework and Recent Legislative Amendments

Key Legislation

Australia’s legal framework to combat money laundering is primarily governed by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) and the Proceeds of Crime Act 2002 (Cth) (POCA). The AML/CTF Act focuses on regulating businesses that provide designated services, requiring them to comply with specific obligations to prevent money laundering and terrorism financing. The POCA allows for the confiscation of proceeds and instruments of crime, including any secondary commercial benefits obtained through criminal activities.

Objectives of the Amendment Act 2024

The Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth) (Amendment Act) aims to enhance Australia’s AML/CTF regime to effectively deter, detect, and disrupt money laundering and terrorism financing, aligning with the Financial Action Task Force (FATF) international standards. The Act has three key objectives:

- Expand the AML/CTF regime to include additional high-risk services provided by tranche two entities.

- Modernise the regulation of digital currencies, virtual assets, and payments technology.

- Simplify and clarify the AML/CTF framework, increasing its flexibility, reducing regulatory impacts, and supporting businesses in preventing and detecting financial crime.

Key Measures Introduced by the Amendment Act

The Amendment Act introduces several significant measures to strengthen the AML/CTF framework:

- Regulating Additional High-Risk Services: The Act brings new designated services under the AML/CTF regime, including real estate professionals, precious metals and stones dealers, and professional service providers such as lawyers and accountants.

- Enhancing AUSTRAC’s Powers: The Act provides AUSTRAC (Australian Transaction Reports and Analysis Centre) with increased authority to enforce compliance, conduct examinations, and obtain necessary information for investigations and prosecutions.

- Changes to Customer Due Diligence (CDD): The Amendment Act updates CDD (Customer Due Diligence) requirements to implement a more outcomes-based framework. This includes reframing core CDD obligations, clarifying when enhanced CDD is necessary, and streamlining conditions for applying simplified CDD.

- Modernising Virtual Asset Regulation: The Act extends AML/CTF regulations to cover additional virtual asset-related services, such as exchanges between virtual assets, transfers on behalf of customers, and safekeeping of virtual assets. It also introduces a new definition of ‘virtual asset’ to include stablecoins and non-fungible tokens (NFTs).

- Repeal of the Financial Transaction Reports Act 1988 (Cth): The Amendment Act repeals the Financial Transaction Reports Act 1988 (Cth), streamlining AML/CTF obligations under a single legislative framework.

These measures collectively aim to bolster Australia’s defences against money laundering and terrorism financing, ensuring the legal framework remains robust and adaptable to emerging financial technologies and threats.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Enforcement and Prosecution of Money Laundering Offences

Complexity of Prosecutions

Prosecuting money laundering offences in Australia presents unique challenges due to several factors:

- Intricate Circumstances: Money laundering cases often involve complex factual scenarios, dealing with funds whose origins span multiple sources and jurisdictions. This complexity makes it difficult to trace the movement and re-distribution of illicit funds.

- International Cooperation: With many investigations requiring evidence from foreign jurisdictions, law enforcement agencies must engage in extensive international cooperation. Different legal systems and procedural requirements can greatly extend the time and resources needed to gather the appropriate evidence.

- Detailed Financial Analysis: Effective prosecution in money laundering cases depends on robust financial analysis. Investigators must demonstrate the origin, flow, and final destination of funds, often through elaborate financial data and transaction records.

- Evolving Criminal Methods: Criminals continually adapt and refine laundering techniques to escape detection, employing sophisticated methods to conceal their activities. As a result, law enforcement agencies also face the challenge of staying ahead of these innovations in money laundering strategies.

Recent Enforcement Actions

The Australian government has taken stringent measures against significant breaches of AML/CTF obligations, underscoring its commitment to curtailing money laundering. Notable enforcement actions in recent years include:

- Tabcorp Group (2017): Federal authorities ordered three companies within the Tabcorp group to pay a total of $45 million for violations of the AML/CTF Act.

- Commonwealth Bank of Australia (2018): The bank faced a penalty of $700 million, marking one of the largest fines in relation to money laundering offences.

- Westpac Banking Corporation (2020): Westpac was fined a record $1.3 billion—the largest civil penalty in Australian history—for significant breaches of AML/CTF obligations.

- Crown Melbourne and Crown Perth (2023): These entities were penalised $450 million for substantial contraventions of the AML/CTF Act, in addition to covering AUSTRAC’s legal costs.

- SkyCity Adelaide Pty Ltd (2024): SkyCity Adelaide was ordered to pay a $67 million penalty, also covering AUSTRAC’s legal expenses.

National Risk Assessment and Vulnerabilities

Australia’s national risk assessment highlights several vulnerabilities that contribute to the ongoing challenges associated with money laundering and the financing of terrorism. The key themes include the adaptability of criminals, rapid technological advancements, and strong connections to criminal markets in Asia.

Persistent and Agile Criminals

- Continuous Adaptation: Criminals are consistently evolving their methods to outmanoeuvre AML/CTF measures. When one laundering channel is blocked, they swiftly transition to alternative strategies, ensuring uninterrupted operations.

- Collaboration and Innovation: The sharing of tactics and insights among criminal groups further complicates law enforcement efforts. Criminal networks experiment with innovative methods to launder illicit funds, maintaining a high degree of agility against enforcement measures.

Technological Advancements

- Speed and Global Reach: Modern payment systems facilitate near-instantaneous transfers across borders, often bypassing traditional regulatory checkpoints. The rapid processing times challenge conventional monitoring and control mechanisms.

- Artificial Intelligence (AI): While AI offers enhanced detection capabilities for identifying suspicious activity, its widespread accessibility allows criminals to deploy more sophisticated schemes.

- Encryption and Digital Currencies: Organised crime groups increasingly rely on technologies like end-to-end encryption and digital currencies to conceal transactions. These tools hinder authorities from tracing funds back to their criminal origins, complicating attribution and enforcement efforts.

Strong Ties to Criminal Markets in Asia

- Economic and Trade Vulnerabilities: Australia’s robust trade relations with Asian markets provide both commercial opportunities and vulnerabilities. Large-scale illicit activities, such as drug trafficking, are often anchored by well-organised criminal networks in Asia.

- Professional Money Laundering Organisations (MLOs): These entities exploit legitimate financial channels to move illicit funds in and out of Australia. The integration of legitimate commerce with criminal activity masks the true origins of the funds, making detection and disruption more difficult.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Socio-Economic Impacts of Money Laundering

Money laundering is not just a regulatory challenge—it has profound socio-economic implications that ripple across crime, public finances, and the reputation of financial institutions in Australia.

Financing and Facilitating Crime

- Enabling Criminal Enterprises: By disguising the origins of illicit funds, money laundering allows criminals to reinvest in further illegal activities. This cycle supports the expansion of crimes such as drug trafficking, human trafficking, and smuggling.

- Sustaining Organised Crime: Access to laundered money enables criminal organisations to grow and maintain their operations, thus magnifying the threat to public safety and security.

Loss of Public Revenue

- Tax Evasion: Money laundering is closely linked to tax evasion, depriving the government of significant revenue. This loss weakens the financial resources available for public services.

- Strain on Essential Services: Reduced public revenue hampers the government’s ability to fund critical sectors like healthcare, education, and infrastructure development. Additionally, the high costs associated with combating money laundering drain further resources from public finances.

- Wider Economic Impact: As essential services suffer and fiscal resources become strained, communities can expect diminished quality of services and overall reduced economic stability.

Reputational Damage to the Financial Sector

- Erosion of Trust: When financial institutions are implicated in money laundering, it undermines public trust and confidence. This reputational harm can discourage legitimate investments and hinder economic growth.

- Systemic Vulnerabilities: Enforcement actions and regulatory penalties against financial institutions for money laundering breaches highlight underlying weaknesses in the financial system. The resulting scrutiny often leads to stricter regulatory standards that affect the sector as a whole.

- Long-Term Economic Consequences: The combined reputational damage and increased regulatory pressures can have lasting effects on the competitiveness and efficiency of Australia’s financial industry.

Conclusion

Money laundering poses significant threats to Australia’s financial system and society, undermining economic stability and facilitating organised crime. The legal framework and recent amendments aim to strengthen regulatory measures and enhance enforcement capabilities. Ongoing efforts by AUSTRAC and other law enforcement agencies are essential in combating the evolving tactics of money launderers.

To effectively combat money laundering and safeguard your business, it is crucial to stay informed and compliant with the latest AML/CTF regulations. Contact our expert team today to ensure your organisation meets all legal obligations and benefits from our proven strategies in mitigating financial crime risks.

Frequently Asked Questions

Money laundering involves hiding, disguising, or legitimising the true origin and ownership of money used in or derived from criminal activities. It serves as a critical component of organised crime, enabling criminals to integrate illicit funds into the formal economy.

The money laundering cycle consists of three stages: placement, layering, and integration. Each stage plays a role in concealing the origins and ownership of illicit funds.

Money laundering in Australia is governed by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) and the Proceeds of Crime Act 2002 (Cth) (POCA).

Common methods used for money laundering include using the banking system and money transfer services to deposit illicit funds. Additionally, creating complex money trails by moving funds through multiple accounts obscures their origin.

The Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth) expands the AML/CTF regime to include additional high-risk services and modernises the regulation of digital currencies. It also simplifies the AML/CTF framework to enhance flexibility and support businesses in preventing financial crimes.

Prosecuting money laundering offences is complex due to the intricate nature of cases that often involve international transactions and multiple jurisdictions. Challenges include the need for detailed financial analysis and extensive evidence gathering to trace illicit funds.

Money laundering significantly supports and expands criminal activities, such as drug trafficking and human trafficking. It also contributes to tax evasion, reducing public revenue and impacting funding for essential services.

AUSTRAC enforces AML/CTF regulations by monitoring financial transactions, conducting compliance investigations, and imposing penalties on non-compliant entities. Recent enforcement actions include substantial fines against major corporations for breaches of the AML/CTF Act.

Vulnerabilities in Australia’s AML/CTF framework include technological advancements that complicate the tracking of illicit transactions and strong ties to Asian criminal markets that facilitate money laundering. Persistent and agile criminals continuously adapt to evade AML/CTF measures, exploiting new methods and technologies.