Introduction

Understanding and adhering to Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) reporting requirements is a crucial responsibility for businesses operating in Australia. These obligations, set out in the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act 2006 (Cth)), are essential tools in the fight against financial crime, including money laundering and terrorism financing (ML/TF), both domestically and internationally.

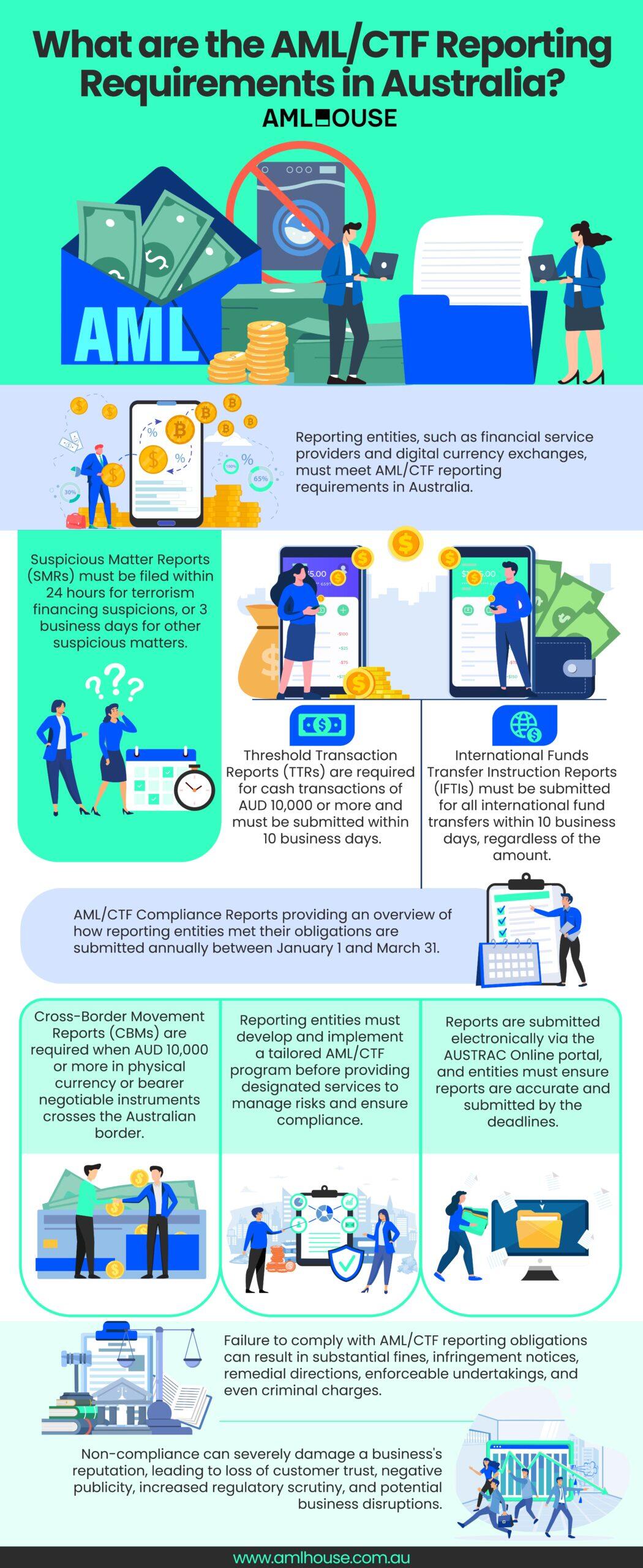

Australian businesses are defined as reporting entities. Those providing designated financial services and digital currency exchange must meet specific reporting obligations to the Australian Transaction Reports and Analysis Centre (AUSTRAC). This guide provides an overview of these key AML/CTF reporting requirements, explaining who a reporting entity is and the types of reports entities must submit to maintain compliance and contribute to the integrity of the Australian financial system.

The Importance of Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Reporting in Australia

Combating Financial Crime and Terrorism Financing

AML/CTF reporting is a critical tool in the broader effort to combat financial crime. By diligently identifying and reporting unusual activities, businesses actively contribute to state and federal law enforcement’s ability to track and apprehend criminals involved in money laundering. These reports are essential for:

- Disrupting criminal networks

- Preventing the misuse of the financial system for illicit purposes

Suspicious Matter Reports (SMRs) are particularly valuable as they help financial crime investigation units follow illicit financial flows and disrupt criminal networks.

When collected nationwide, seemingly minor reports combine to create a comprehensive picture of criminal activity. This aggregated data helps connect seemingly insignificant activities to larger money laundering schemes and organised crime networks.

Notably, the reporting of suspicious matters is not based on the monetary value of a transaction, but rather on the suspicion itself. This means that even small, unusual transactions or behaviours must be reported if there are reasonable grounds for suspicion of (ML/TF).

Maintaining the Integrity of the Australian Financial System

Beyond combating specific crimes, AML/CTF reporting plays a vital role in maintaining the overall integrity of the Australian financial system. Accurate and timely reporting helps to:

- Detect criminal and terrorist activities

- Deter illicit financial operations

- Disrupt ongoing criminal schemes

By analysing the submitted reports, the Australian Transaction Reports and Analysis Centre (AUSTRAC) can identify patterns of criminal activity, including ML/TF. This analysis is crucial for sharing intelligence with partners in Australia and overseas, aiding the broader fight against crime and ensuring a stable and trustworthy financial environment.

The reports that reporting entities must submit to AUSTRAC provide essential data that contributes to a robust and resilient financial system. This system is better equipped to withstand and combat threats from ML/TF.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Who Needs to Report AML/CTF in Australia?

Definition of Reporting Entities under the AML/CTF Act

Certain businesses are classified as reporting entities under the Australian Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act 2006 (Cth)). These entities must comply with reporting requirements for reporting AML/CTF. Specifically, reporting entities are businesses that provide designated services. Therefore, these entities must understand their reporting obligations under this act.

Designated Services and Business Categories

Reporting entities are obligated to meet compliance requirements because they provide designated services. These services carry a higher risk of ML/TF. The types of businesses that offer designated services and are, therefore, considered reporting entities include:

- Financial service providers: This category includes banks, credit unions, and other lenders offering various financial services. These institutions are central to the financial system and handle large financial transactions, making them key players in anti-money laundering efforts.

- Digital currency exchange providers: Businesses facilitating the exchange of digital currencies fall under this category. The increasing use of digital currencies in financial transactions, along with their potential for anonymity, can be exploited for illicit activities like ML/TF.

- Remittance service providers: These services facilitate money transfers, especially internationally, and are considered reporting entities. The remittance sector is crucial in monitoring cross-border financial flows and preventing ML/TF

- Bullion dealers: Businesses dealing in precious metals are included because precious metals can be used in financial transactions to store and transfer value and may be susceptible to money laundering.

- Gambling service providers: Casinos, bookmakers, and other gambling services are also categorised as reporting entities. The gambling industry can be vulnerable to money laundering due to the large amounts of cash handled and the nature of financial transactions involved.

These categories are defined in the AML/CTF Act 2006 (Cth) and highlight sectors where customer due diligence and robust AML/CTF measures are essential to mitigate and manage the risk of ML/TF.

Key AML/CTF Reporting Requirements for Australian Businesses

SMRs

SMRs are critical for reporting entities in Australia. These reports must be filed when a reporting entity suspects, on reasonable grounds, that a transaction, attempted transaction, or any related activity may be connected to illicit activities. These activities include:

- Money laundering

- Terrorism financing

- The proceeds of crime

- Tax evasion

- Other serious criminal offences

The obligation to report a suspicious matter is based on suspicion alone, not on the monetary value of the transaction. Even small transactions can trigger an SMR if they appear unusual or raise concerns.

The timeframe for submitting an SMR to AUSTRAC depends on the nature of the suspicion:

- Terrorism financing: Report must be submitted within 24 hours of forming the suspicion.

- Other suspicious matters: Report must be submitted within 3 business days of forming the suspicion.

The primary purpose of SMRs is to provide crucial financial intelligence to AUSTRAC and law enforcement agencies. By reporting suspicious matters, reporting entities play a vital role in helping authorities detect, disrupt, and prevent ML/TF. These reports contribute to a broader effort to combat financial crime and safeguard the integrity of the Australian financial system.

Threshold Transaction Reports (TTRs)

Threshold Transaction Reports (TTRs) are mandatory for reporting entities when they engage in transactions involving significant amounts of physical currency. Specifically, a TTR is required for any transaction involving physical cash of AUD 10,000 or more or its foreign currency equivalent. This reporting obligation applies regardless of whether the transaction appears suspicious; the threshold is the determining factor. This includes:

- Single transactions exceeding the threshold

- Multiple smaller cash transactions conducted by the same person on the same day that cumulatively reach or exceed AUD 10,000

Reporting entities must submit TTRs to AUSTRAC within 10 business days after the transaction’s date. This timeframe ensures that AUSTRAC receives timely information about large cash transactions.

The primary purpose of TTRs is to assist AUSTRAC in tracking substantial physical cash movements within the financial system. Large cash transactions are often associated with money laundering schemes and other illicit activities. By monitoring these transactions, AUSTRAC can identify and investigate potential criminal behaviour and take steps to mitigate the risks associated with large cash movements.

International Funds Transfer Instruction Reports (IFTIs)

International Funds Transfer Instruction Reports, or IFTIs, are another key reporting obligation for reporting entities in Australia. IFTIs are required for instructions to:

- Send funds or property out of Australia

- Receive funds or property from outside Australia

This reporting requirement applies to various international fund transfers, including electronic transfers and transactions facilitated through remittance service providers. Notably, there is no minimum monetary threshold for IFTIs; all international fund transfers, regardless of value, must be reported.

Reporting entities must submit IFTIs to AUSTRAC within 10 business days of sending or receiving the international funds transfer instruction. This timeframe allows for the efficient collection of data on cross-border financial flows.

The purpose of IFTIs is to monitor cross-border financial movements, which are often exploited in international ML/TF operations.

AML/CTF Compliance Reports

AML/CTF Compliance Reports are annual reports that reporting entities must submit to AUSTRAC. These reports provide a comprehensive overview of how each reporting entity has met its AML/CTF compliance obligations throughout the reporting period. The compliance report typically involves answering a detailed questionnaire provided by AUSTRAC, which covers various aspects of the entity’s AML/CTF framework, including:

- Risk assessment methodologies

- Implementation and effectiveness of the AML/CTF program

- Customer due diligence procedures

- Employee training initiatives

- Internal oversight mechanisms

These compliance reports are submitted annually, covering January 1 to December 31. The submission window is between January 1 and March 31 of the following year. AUSTRAC typically notifies reporting entities when their compliance report is due, ensuring they know their reporting obligation and the submission timeframe.

The primary purpose of AML/CTF Compliance Reports is to enable AUSTRAC to assess compliance within regulated industries. By analysing these reports, AUSTRAC can identify industry-wide trends, evaluate the effectiveness of AML/CTF measures across different sectors, and target its supervisory efforts and resources towards areas where compliance may be lacking or where risks are more pronounced. These reports are crucial for AUSTRAC to maintain oversight of reporting entities and ensure the ongoing integrity of Australia’s AML/CTF) regime.

Cross-Border Movement Reports (CBMs)

Cross-Border Movement Reports, or CBMs, are required when physical currency or bearer negotiable instruments are moved into or out of Australia and the value is AUD 10,000 or more. This reporting obligation applies to everyone, not just reporting entities. This includes situations where individuals:

- Carry physical currency across the border

- Send monetary instruments via mail, freight, or courier services

If a person or entity is sending monetary instruments out of Australia, the CBM report must be submitted to AUSTRAC before the instruments are sent. Conversely, if financial instruments are received from outside Australia, the CBM report must be submitted within 5 business days.

Reporting cross-border movements of monetary instruments is important because such movements can pose significant ML/TF risks. By requiring reports on these movements, AUSTRAC aims to monitor and control the flow of large sums of currency across Australia’s borders. This helps detect and prevent illicit funds from entering or leaving the country, which is crucial in the fight against financial crime and in protecting Australia from ML/TF.

AML/CTF Compliance Program: A Cornerstone of Reporting

Developing and Implementing an AML/CTF Program

Developing and implementing an AML/CTF program is essential for reporting entities to effectively manage the risks of ML/TF. An AML/CTF program serves as a documented framework that outlines how a business:

- Identifies risks associated with ML/TF,

- Mitigates these risks,

- Manages the ongoing threats related to their designated services.

Establishing this compliance framework is crucial before a business begins to provide designated services.

A robust AML/CTF program should be tailored to the reporting entity’s nature, scale, and designated services. This program is a formality and a practical tool designed to ensure ongoing compliance with the AML/CTF Act 2006 (Cth) and related regulations. Effectively managing ML/TF risks requires a well-structured and actively maintained AML/CTF program.

The Role of the AML/CTF Program in Meeting Reporting Obligations

A well-structured AML/CTF program ensures that reporting entities meet their reporting obligations accurately and promptly. The program provides the framework for:

- Identifying and reporting suspicious matters,

- Tracking threshold transactions,

- Monitoring international funds transfers,

By embedding customer due diligence and transaction monitoring processes, the AML/CTF program facilitates the detection of activities that must be reported to AUSTRAC.

Furthermore, the AML/CTF program is integral to the annual AML/CTF Compliance Reports that entities must submit to AUSTRAC. These compliance reports require reporting entities to detail how they have met their AML/CTF compliance obligations, and the AML/CTF program provides the substance for these reports. A comprehensive AML/CTF program is about managing risks, demonstrating ongoing compliance, and fulfilling all reporting requirements to AUSTRAC.

Reporting Processes and Submission Methods

Submitting Reports via AUSTRAC Online

Reporting entities must submit AML/CTF reports to AUSTRAC electronically through the AUSTRAC Online portal. This secure and efficient system supports the submission of various reports, including:

- SMRs

- TTRs

- IFTIs

- AML/CTF Compliance Reports

To submit a report via AUSTRAC Online, follow these steps:

- Log in to AUSTRAC Online: Access the portal using your registered credentials.

- Navigate to the Transaction Reporting Menu: Locate the ‘transaction reporting’ section once logged in.

- Create a New Report: Click on the option to create a new report, typically indicated by a ‘+’ symbol or a ‘create amend reports’ button.

- Select the Report Type: Choose the specific type of report you need to submit (e.g., SMR, TTR).

- Complete the Report Form: Complete all required fields in the online form to ensure accurate and detailed information.

- Review and Submit: Carefully review all entered information for accuracy and completeness before submitting the report through the portal.

AUSTRAC Online provides a structured and secure method for fulfilling reporting obligations under the AML/CTF Act 2006 (Cth).

Ensuring Accuracy and Meeting Deadlines

Submitting accurate and timely reports is crucial for effective AML/CTF compliance. The reports submitted by reporting entities enable AUSTRAC to analyse patterns of criminal activity, including ML/TF. This analysis is then shared with partners in Australia and overseas to aid in the investigation and combating of crime.

To ensure accuracy and meet reporting deadlines, consider the following practices:

- Implement Robust Internal Processes: Establish clear procedures for identifying, verifying, and reporting transactions and suspicious matters.

- Provide Comprehensive Training: Ensure staff are well-trained on AML/CTF reporting requirements, including identifying suspicious activities and accurately completing reports.

- Utilise Technology for Audit Trails: Employ systems that create audit trails and centralise records to streamline reporting and maintain accuracy.

- Document All Relevant Information: Maintain thorough documentation of customer due diligence, transaction details, and any grounds for suspicion.

- Stay Informed of Deadlines: Be aware of the specific timeframes for each type of report (e.g., within 24 hours for terrorism financing SMRs, 10 business days for TTRs and IFTIs.

- Regularly Review and Update AML/CTF Programs: Continuously evaluate and enhance your AML/CTF program to ensure it supports accurate and timely reporting.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Consequences of Non-Compliance with AML/CTF Reporting

Penalties for Failure to Report

Failure to meet AML/CTF reporting obligations carries significant consequences for reporting entities in Australia. AUSTRAC enforces strict compliance, and non-adherence can result in various penalties, to ensure businesses take their AML/CTF responsibilities seriously. The penalties for non-compliance can include:

- Substantial fines: Significant monetary penalties can be imposed on businesses that fail to meet their reporting obligations. These fines are intended to act as a deterrent.

- Infringement notices: AUSTRAC may issue infringement notices for less severe compliance breaches. These notices often involve financial penalties and require the reporting entity to take corrective action.

- Remedial directions: AUSTRAC can direct a reporting entity to take specific steps to rectify its compliance failures. This might include improving its AML/CTF program or enhancing its customer due diligence processes.

- Enforceable undertakings: In more serious cases, AUSTRAC may seek enforceable undertakings from reporting entities. These are legally binding agreements that commit the entity to specific actions to improve compliance.

- Criminal charges: Criminal charges may be pursued for severe or repeated breaches of the AML/CTF Act 2006 (Cth). This can lead to imprisonment for individuals involved in the non-compliance.

Reputational Damage and Business Impact

Beyond the direct financial and legal penalties, non-compliance with AML/CTF reporting can inflict significant reputational damage on a business. Maintaining a strong reputation is crucial for business success and customer trust in today’s environment. Failure to comply with AML/CTF regulations can tarnish a business’s image.

The negative impacts on a business’s reputation and operations can include:

- Loss of customer trust: Customers may lose confidence in a business that is seen to be failing in its obligations to protect against ML/TF. This erosion of trust can lead to customer attrition and difficulty attracting new clients.

- Damage to brand image: News of non-compliance can significantly damage a business’s brand image and public perception. Negative publicity surrounding AML/CTF failures can be difficult and costly to overcome.

- Increased regulatory scrutiny: Businesses found non-compliant may face increased scrutiny from AUSTRAC and other regulatory bodies. This can result in more frequent audits and a more intensive level of oversight, adding to operational burdens.

- Business disruption: Serious compliance failures can lead to business disruptions, including potential suspensions of operating licenses or restrictions on business activities. These disruptions can have significant financial and operational consequences.

Conclusion

For businesses operating in Australia, understanding and diligently adhering to anti-money laundering and counter-terrorism financing (AML/CTF) reporting requirements is more than a matter of compliance. It is a fundamental responsibility. These obligations, mandated by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth)(AML/CTF Act 2006 (Cth)), are critical for safeguarding the Australian financial system from misuse and actively combating money laundering, terrorism financing, and other serious financial crimes.

By fulfilling their reporting obligations, reporting entities play a vital role in providing crucial financial intelligence to the Australian Transaction Reports and Analysis Centre (AUSTRAC) and law enforcement, contributing significantly to national security and the integrity of the financial sector.

Navigating the complexities of AML/CTF compliance can be challenging, but it is essential for every reporting entity to meet these reporting requirements effectively. To ensure your business is fully compliant and contributing to the fight against financial crime, contact AML House today. Our team offers unparalleled expertise in AML/CTF, providing tailored solutions and guidance to help you confidently meet all your AML/CTF reporting obligations.

Frequently Asked Questions

The primary goal of reporting anti-money laundering and counter-terrorism financing (AML/CTF) in Australia is to combat financial crime, including money laundering and terrorism financing (ML/TF), and to maintain the integrity of the Australian financial system. By submitting reports on unusual or large transactions, reporting entities provide crucial information that helps law enforcement track and disrupt criminal activities.

Under Australian AML/CTF law, a reporting entity is a business that provides ‘designated services’ as defined in the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act 2006 (Cth)). These designated services include financial service providers such as banks and lenders, digital currency exchange providers, remittance service providers, bullion dealers, and gambling service providers. It is crucial to understand whether your business falls under the definition of a reporting entity to ensure compliance with reporting obligations.

Five main types of reports that reporting entities are required to submit to AUSTRAC. These include;

• Suspicious Matter Reports (SMRs): which are filed when there is suspicion of illicit activity;

• Threshold Transaction Reports (TTRs): for transactions involving AUD 10,000 or more in physical cash;

• International Funds Transfer Instruction Reports (IFTIs): for international fund transfers;

• AML/CTF Compliance Reports: which are annual overviews of compliance measures; and

• Cross-Border Movement Reports (CBMs): for physical currency movements of AUD 10,000 or more across Australian borders.

Each of these reports plays a vital role in Australia’s fight against financial crime.

If the suspicion is related to terrorism financing, an SMR should be submitted within 24 hours. For other suspicious matters, such as money laundering, the timeframe for submitting an SMR is within 3 business days of forming the suspicion. It is important to act promptly once a suspicion is formed to ensure timely reporting to AUSTRAC.

The threshold for submitting a Threshold Transaction Report (TTR) is any transaction involving physical currency (cash) of AUD 10,000 or more or its foreign currency equivalent. This reporting obligation is triggered whenever a single financial transaction or multiple related financial transactions in cash reach or exceed this amount. TTRs are essential for tracking large cash movements and mitigating the risk of money laundering.

There is no minimum monetary threshold for International Funds Transfer Instruction Reports (IFTIs). All international fund transfers, regardless of amount, must be reported to AUSTRAC. This comprehensive reporting obligation ensures that AUSTRAC has visibility over all cross-border financial flows, which is crucial for monitoring and mitigating the risk of ML/TF.

AML/CTF Compliance Reports are submitted annually by reporting entities. They cover the period from January 1 to December 31 of each year and must be submitted to AUSTRAC between January 1 and March 31 of the following year. These annual reports provide AUSTRAC with an overview of how reporting entities meet their compliance obligations.

The timeframe for reporting cross-border movements of monetary instruments depends on whether you send or receive them. If you send monetary instruments out of Australia via mail or shipping, you must report them to AUSTRAC before sending them. If you receive monetary instruments from overseas, you must report them within 5 business days of receipt. Timely reporting of cross-border movements is critical for AML/CTF efforts.

Failing to comply with AML/CTF reporting obligations can result in significant penalties. These penalties include substantial fines, infringement notices, remedial directions, and enforceable undertakings. In severe cases of non-compliance, criminal charges and imprisonment may also apply. Furthermore, non-compliance can lead to serious reputational damage and adverse impacts on business operations.