Introduction

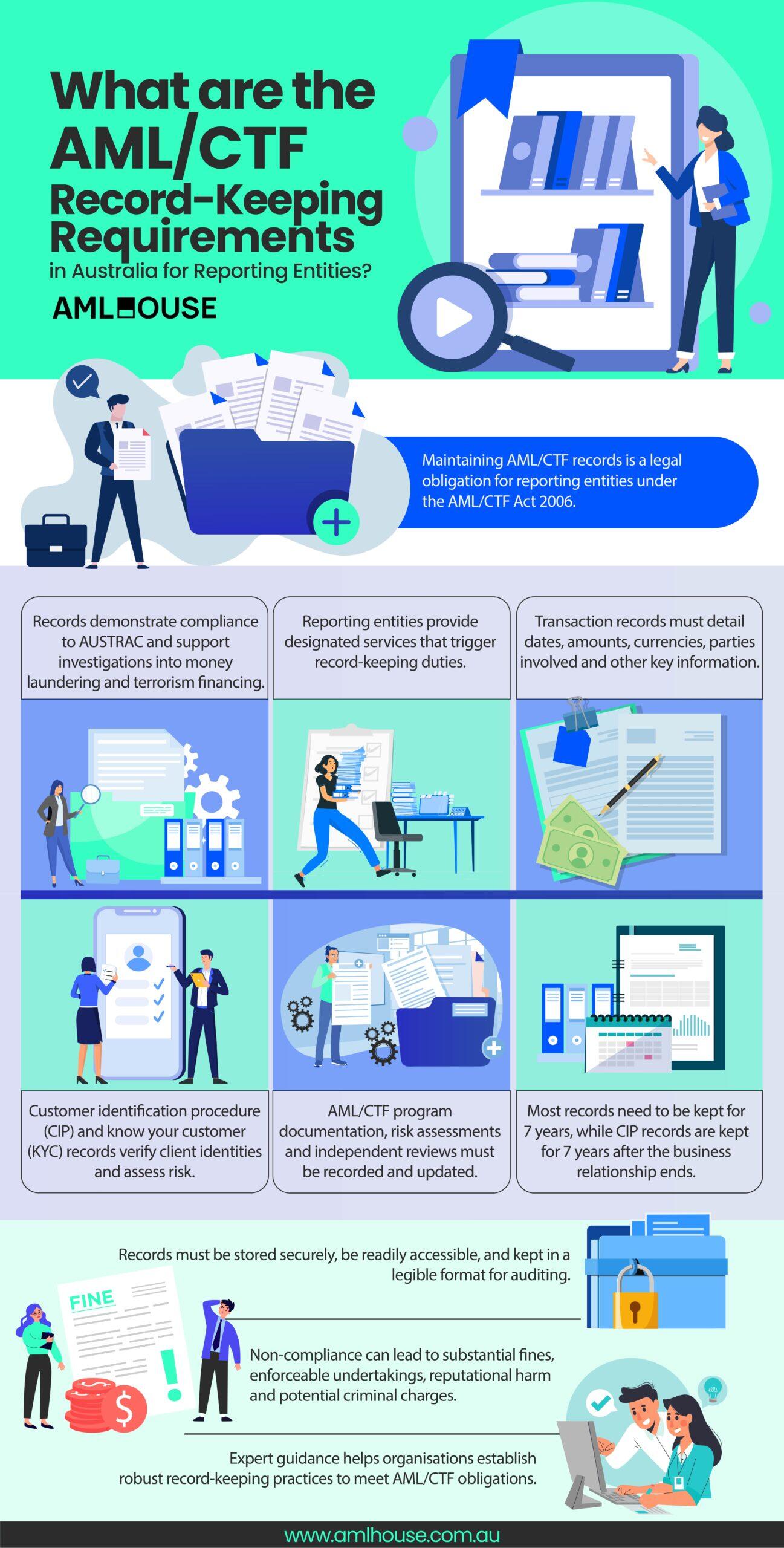

Maintaining effective anti-money laundering and counter-terrorism financing (AML/CTF) record-keeping is a critical legal obligation for reporting entities in Australia. These record-keeping requirements are mandated under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act 2006 (Cth)). They are rigorously overseen by the Australian Transaction Reports and Analysis Centre (AUSTRAC), Australia’s financial intelligence unit. Robust record-keeping is essential to combating money laundering and terrorism financing (ML/TF), ensuring compliance, and supporting investigations into potential money laundering or terrorism financing activities.

For businesses that provide designated services and are classified as reporting entities, understanding and adhering to AML/CTF record-keeping requirements is a legal obligation and a crucial aspect of mitigating and managing risks associated with financial crime. This guide provides essential information on navigating AML/CTF record keeping, explaining who reporting entities are, what records must be kept, and why compliance is paramount for demonstrating due diligence and fulfilling reporting obligations.

Understanding the Importance of Australian Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Record Keeping

Demonstrating AML/CTF Compliance with the Australian Transaction Reports and Analysis Centre (AUSTRAC)

Maintaining thorough records is essential for reporting entities to demonstrate their compliance with Australian Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) obligations. Records allow businesses to show the Australian Transaction Reports and Analysis Centre (AUSTRAC) and auditors that they are fulfilling their legal obligations and adhering to current legislation.

Robust record-keeping practices provide tangible evidence of an organisation’s commitment to preventing financial crime. For instance, consider a scenario where AUSTRAC requests information from a reporting entity as part of a routine compliance assessment.

Having easily accessible and well-maintained records of:

- Customer identification procedures (CIP)

- Transaction details

- AML/CTF program documentation

These enable the entity to promptly provide the necessary information. This demonstrates to AUSTRAC that the reporting entity has implemented and is actively following its AML/CTF program, thereby meeting its compliance responsibilities.

Assisting with Investigations into Money Laundering and Terrorism Financing (ML/TF)

Detailed records are critical when assisting AUSTRAC and law enforcement agencies in investigating potential money laundering and terrorism financing (ML/TF) activities. If a business is misused for criminal purposes, the records maintained by the reporting entity can provide essential information to authorities.

These records are crucial for tracing the flow of funds and identifying suspicious patterns that may indicate illicit activities. Imagine a situation where law enforcement is investigating a complex money laundering scheme.

Transaction records, including details of:

- International funds transfers

- Customer information

These become invaluable in piecing together the financial transactions and identifying individuals involved. By providing a clear audit trail, these records enable authorities to effectively investigate and prosecute those engaged in money laundering or terrorism financing.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Who are Reporting Entities, and Why Must They Keep AML Records?

Defining Reporting Entities Under the AML/CTF Act

Under Australia’s AML/CTF legislation, specific individuals and businesses are classified as reporting entities. These reporting entities are obligated to adhere to AML/CTF responsibilities, which include:

- Strict record-keeping practices: Ensuring that all financial transactions and customer interactions are thoroughly documented.

- Compliance with the AML/CTF Act 2006 (Cth): Meeting all legal obligations to help prevent financial crimes.

Designated Services Triggering Record-Keeping Obligations

The specific types of records a reporting entity must keep, along with the duration for which they must be retained, are determined by the designated services they provide. Designated services encompass a range of activities that trigger AML/CTF obligations, including:

- Financial Services: Services provided by banks, credit unions, and building societies.

- Remittance Services: Providers that handle money transfers.

- Digital Currency Exchange: Entities facilitating the exchange of digital currencies.

- Gambling Services: Operations involved in gambling activities.

- Bullion Dealers: Businesses dealing with precious metals.

- Financial Planners and Advisors: Professionals offering financial planning and advisory services.

Types of AML/CTF Records Reporting Entities Must Maintain

Transaction Records for Designated Services

Reporting entities must maintain comprehensive records of all transactions related to the designated services they provide. These transaction records are essential for creating a clear audit trail, which is vital for investigations into potential ML/TF activities. To ensure compliance and facilitate investigative purposes, these records must capture key details of each transaction.

The details that must be recorded for each transaction include:

- Date and Time: The precise date and time when the transaction occurred, providing a chronological reference point.

- Transaction Type: The nature of the transaction, such as deposit, withdrawal, funds transfer, or currency exchange, to understand the transaction’s purpose.

- Value and Currency: The exact amount of money or digital currency involved and the currency type crucial for tracking financial flows.

- Parties Involved: Details of all parties involved in the transaction, including customer names, account numbers, and any other identifying information available, to establish who is conducting the transaction.

- Transaction Initiation Method: How the transaction was initiated, whether in person, online, or via other means, to understand the context of the transaction.

CIP Records and Know Your Customer (KYC) Data

Maintaining thorough records of CIP and Know Your Customer (KYC) data is a critical AML/CTF obligation for reporting entities. These records document the steps taken to verify customer identity and the information collected during this process. They are essential for demonstrating that the reporting entity has conducted appropriate customer due diligence.

The key components of CIP and KYC records include:

- Identification Procedures Undertaken: A detailed record of all steps taken to identify the customer, ensuring a clear account of the verification process.

- Identifying Information Presented: The core customer profile is formed by specific identifying information provided by the customer, such as name, date of birth, and residential address.

- Verification Documents: Records of the documents used to verify the customer’s identity, like passport or driver’s license details, or copies of these documents if taken. While physical copies are not mandatory, recording document details is essential, and copies, if made, become part of the required records.

- Beneficial Ownership Information: If the customer is not an individual, records identifying and verifying the beneficial owners are necessary to understand who ultimately controls the entity.

- Purpose and Nature of Business Relationship: Documentation outlining why the customer is engaging with the reporting entity and the intended nature of their business relationship, providing context for ongoing transactions.

- Politically Exposed Person (PEP) Checks: Records of checks conducted to determine if the customer or beneficial owner is a PEP which necessitates enhanced due diligence.

- Customer Risk Ratings: The assessed risk level of the customer and the methodology used to determine this rating reflect the entity’s risk-based approach.

- Ongoing Due Diligence Actions: Records of any ongoing monitoring or due diligence activities conducted throughout the business relationship, demonstrating continuous oversight.

AML/CTF Program Documentation and Updates

Reporting entities are legally obligated to document and maintain records of their AML/CTF program. This documentation serves as evidence of the entity’s framework for managing and mitigating ML/TF risks. These records must reflect the program’s implementation, oversight, and any modifications over time.

Essential elements of AML/CTF program documentation and updates include:

- Date of Program Adoption: Records indicating when the AML/CTF program was formally adopted, often through board minutes or similar approvals, establishing the program’s commencement.

- Approval Details: Information on who approved the adoption of the program, demonstrating senior management oversight and accountability.

- The AML/CTF Program Document: A copy of the complete, written AML/CTF program itself, detailing all policies, procedures, and controls.

- Records of Program Changes: Document any changes or updates made to the AML/CTF program over time, including the dates and nature of these changes, to ensure the program remains current and effective.

- Independent Review Records: Records of any independent reviews conducted on the AML/CTF program, including findings and recommendations, to ensure ongoing program effectiveness and compliance.

- Risk Assessments: Documentation of AML/CTF risk assessments undertaken by the reporting entity, including methodologies and findings, which inform the program’s risk-based approach.

- Training Records: Records of AML/CTF training provided to staff, including content, dates, and attendees, demonstrating efforts to ensure staff competency in AML/CTF compliance.

Record Retention Periods and Secure Storage Requirements

Prescribed Retention Periods for AML Records

Reporting entities in Australia must retain records related to their AML/CTF obligations for specific periods. The general rule mandates that most AML/CTF records be kept for seven years. This retention period is crucial for several reasons:

- Investigations: Ensures that records are available for AUSTRAC or law enforcement to investigate potential ML/TF activities.

- Compliance Demonstration: Allows reporting entities to demonstrate their adherence to record-keeping requirements under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth).

The seven-year retention period applies to various types of AML/CTF records, including:

- Transaction Records: These records must be retained for seven years from the date the transaction occurred. They are essential for creating an audit trail of financial activities.

- AML/CTF Program Records: Documentation related to a reporting entity’s AML/CTF program, such as risk assessments and program updates, must be kept for seven years after the program is no longer in effect.

- Records Related to Credit Reporting Agencies: Any records related to requests made to credit reporting agencies for customer verification must be retained for seven years from the date of the request.

- Correspondent Banking Due Diligence Records: Records of due diligence assessments undertaken on correspondent banking relationships must be kept for seven years after the record was created.

A different retention period applies to CIP records. These records must be maintained for the duration of the business relationship with the customer and an additional seven years after the reporting entity ceases to provide any designated services to that customer. This extended period acknowledges the ongoing importance of customer due diligence information.

Secure Storage, Accessibility, and Format of Records

In addition to prescribed retention periods, reporting entities must adhere to specific requirements regarding the secure storage, accessibility, and format of their AML/CTF records. These requirements ensure that records are not only retained for the required duration but are also readily available and protected from unauthorised access or loss.

Key requirements include:

- Secure Storage: Records must be stored securely to protect them from unauthorised access, modification, loss, or destruction. This applies to both hard copy and electronic records. Secure storage is essential for maintaining the integrity and confidentiality of sensitive customer and transaction data and for complying with privacy obligations.

- Accessibility: Records must be readily accessible and retrievable. Reporting entities must be able to locate and provide records to AUSTRAC or other relevant authorities within a reasonable timeframe upon request. AUSTRAC generally expects records to be retrievable within 24 to 72 hours.

- Format of Records: Records can be maintained in either hard copy or electronic format. AUSTRAC does not mandate a specific format, allowing flexibility for reporting entities to choose the format that best suits their operations. However, regardless of the chosen format, records must be legible and capable of being audited. For electronic records, it is important to ensure they are stored in a manner that guarantees their security and accessibility.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Consequences of Non-Compliance with AML/CTF Record-Keeping

Financial Penalties and Reputational Damage for Non-Compliance

Failure to comply with AML/CTF record-keeping obligations can result in significant financial penalties imposed by AUSTRAC. These penalties serve as a deterrent and underscore the importance of adhering to regulatory requirements. Civil penalties for record-keeping breaches can be substantial, potentially reaching up to $313,000 per violation.

Beyond financial repercussions, non-compliance can severely damage an organisation’s reputation. Reputational damage can erode customer trust and confidence, impacting long-term business viability. For businesses that provide designated services, maintaining a strong reputation is crucial. AML/CTF compliance is a key component of building and preserving that trust.

Enforceable Undertakings and Potential Criminal Charges

In addition to financial penalties, AUSTRAC has the authority to issue enforceable undertakings or remedial directions to reporting entities that fail to meet their AML/CTF record-keeping obligations:

- Enforceable Undertakings: These are legally binding agreements where an entity commits to specific actions to rectify non-compliance.

- Remedial Directions: These are instructions from AUSTRAC requiring specific corrective measures.

In severe cases of non-compliance, particularly those involving wilful or systemic breaches, there is a risk of criminal charges. These charges can be brought against directors or senior management, who are deemed responsible for the failures. Criminal convictions can lead to imprisonment, highlighting the severe consequences of neglecting AML/CTF record-keeping responsibilities.

Conclusion

Maintaining diligent Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) record-keeping practices is not merely an administrative task, but a fundamental legal obligation for reporting entities in Australia. Robust record keeping, as mandated by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) and overseen by the Australian Transaction Reports and Analysis Centre (AUSTRAC), is crucial for demonstrating AML/CTF compliance and actively combating financial crime.

By meticulously documenting transaction records, customer identification procedure (CIP) records, and AML/CTF program documentation, organisations can effectively mitigate and manage the risks of money laundering and terrorism financing (ML/TF) while also providing essential support for investigations into potential illicit activities.

To ensure your organisation adheres to these critical record-keeping requirements and maintains robust AML/CTF compliance, it is essential to seek expert guidance. Contact AML House today to explore our proven solutions and specialised knowledge in AML/CTF practices. Let our unparalleled expertise assist you in establishing and maintaining effective record-keeping practices, safeguarding your organisation, and contributing to the broader fight against ML/TF.

Frequently Asked Questions

The primary legislation governing Australian Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) record keeping in Australia is the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth). This Act sets out the legal framework and obligations for reporting entities in Australia.

Reporting entities must generally keep AML/CTF records for seven years. This retention period ensures that records are available for investigations and to demonstrate compliance with regulatory obligations.

Reporting entities are required to maintain several types of records to comply with AML/CTF obligations. These include:

• Transaction records related to designated services.

• Customer identification procedure (CIP) records and Know Your Customer (KYC) data.

• AML/CTF program documentation and updates.

Records can be kept in electronic or hard copy format. The Australian Transaction Reports and Analysis Centre (AUSTRAC) allows flexibility in record format, provided that the records are stored securely, readily accessible, and auditable when necessary.

AUSTRAC is the primary regulatory body responsible for overseeing AML/CTF obligations in Australia. It enforces the AML/CTF Act and ensures that reporting entities comply with record-keeping and other regulatory requirements.

Failing to comply with AML/CTF record-keeping obligations can lead to significant consequences. These consequences can include financial penalties, reputational damage, and potential enforcement actions from AUSTRAC.

Yes, remittance service providers and digital currency exchange providers have additional record-keeping requirements. Due to the higher-risk nature of their services, these entities face extra obligations to help mitigate and manage risks associated with money laundering and terrorism financing (ML/TF).

There are limited exemptions from AML/CTF record-keeping requirements. One example is for designated services provided by a reporting entity through a permanent establishment in a foreign country, although even in these cases, some record-keeping obligations still apply.

Businesses can consult several key resources for more detailed guidance on AML/CTF record keeping. These resources include the AML/CTF Act, the AML/CTF Rules, and the comprehensive guidance available on AUSTRAC’s official website.