Introduction

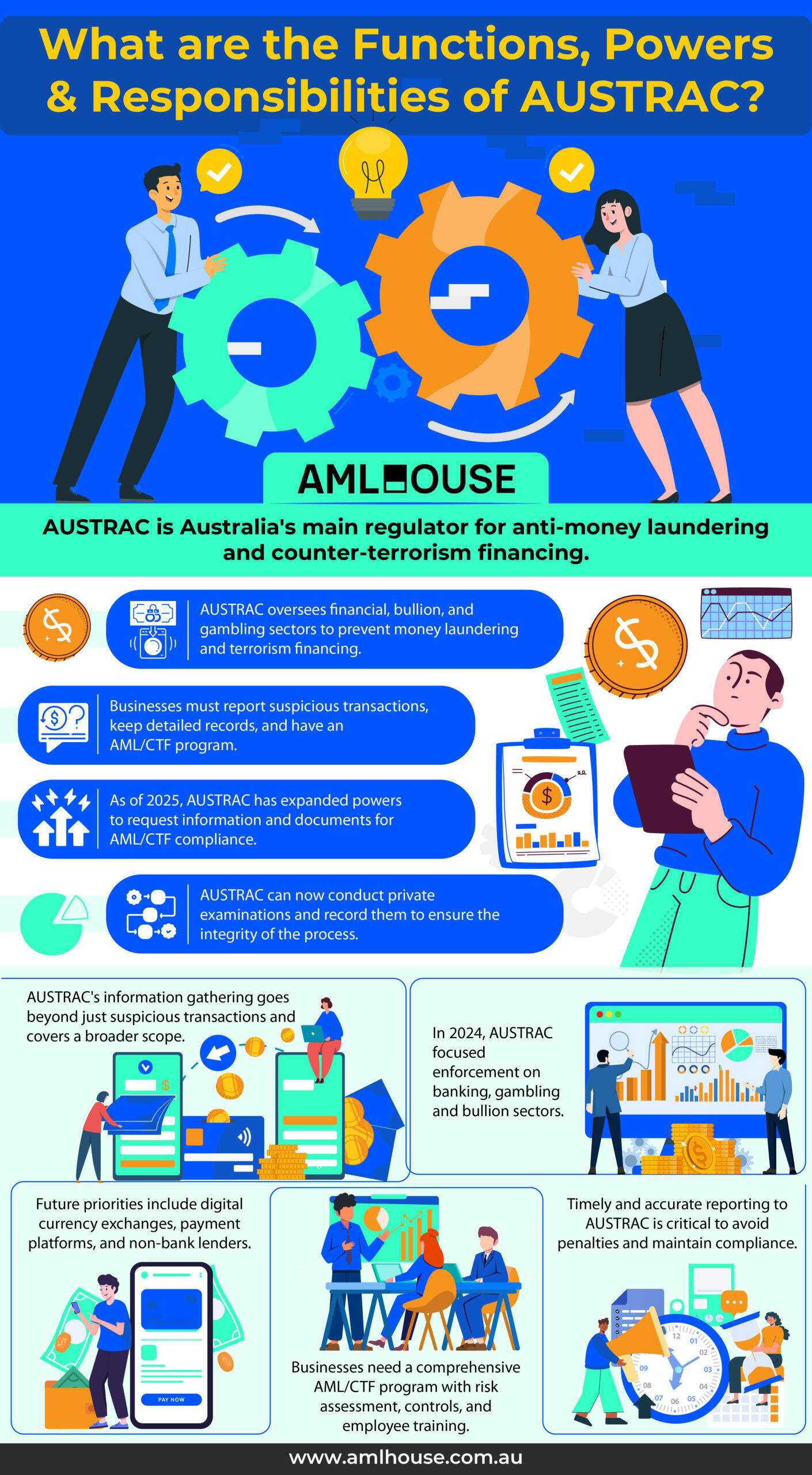

The Australian Transaction Reports and Analysis Centre (AUSTRAC) is Australia’s leading regulatory body for anti-money laundering (AML) and counter-terrorism financing (CTF). It oversees designated services in the financial, bullion, and gambling sectors, ensuring that organisations comply with AML/CTF obligations to prevent money laundering and terrorism financing.

With the implementation of the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth), effective January 2025, AUSTRAC’s powers have significantly expanded. This enhancement strengthens AUSTRAC’s ability to enforce AML/CTF laws, highlighting its pivotal role in safeguarding Australia’s financial system.

What is AUSTRAC?

Overview of AUSTRAC

AUSTRAC, the Australian Transaction Reports and Analysis Centre, is Australia’s primary regulatory authority for combating money laundering and terrorism financing. Established to oversee and regulate designated services within the financial, bullion, and gambling sectors, AUSTRAC plays a crucial role in maintaining the integrity of Australia’s financial system. As a regulator, it:

- Monitors business activities that pose significant money laundering and terrorism financing risks

- Assesses these activities to ensure compliance with stringent AML/CTF obligations

AUSTRAC’s Mission and Objectives

AUSTRAC’s mission is to detect, deter, and disrupt money laundering, terrorism financing, and other serious financial crimes in Australia. To achieve this, AUSTRAC implements and enforces the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth). In doing so, reporting entities are required to:

- Report certain transactions

- Maintain comprehensive records

- Establish robust AML/CTF programs

Furthermore, by serving as Australia’s Financial Intelligence Unit (FIU), AUSTRAC analyses transaction reports identifying suspicious activities and collaborates with law enforcement agencies to prosecute financial crimes. Through these efforts, AUSTRAC ensures that Australia remains resilient against financial threats and upholds global standards in AML/CTF compliance.

AUSTRAC’s Responsibilities in AML/CTF

Regulation of Designated Services

AUSTRAC regulates designated services within the financial, bullion, and gambling sectors due to their higher risks for money laundering and terrorism financing.

Financial Services:

- Account and Deposit Taking Services: Including banks, building societies, and credit unions.

- Remittance Services: Facilitating money transfers domestically and internationally.

- Digital Currency Exchange: Managing the exchange of cryptocurrencies for traditional currencies and vice versa.

Bullion Services:

- Trading Bullion: Buying and selling precious metals like gold, silver, platinum, and palladium.

Gambling Services:

- Betting Accounts: Managing betting accounts and facilitating gambling transactions.

- Gaming Machines: Operating electronic gaming machines in casinos and other venues.

These designated services are monitored closely to detect and prevent potential money laundering and terrorism financing activities, ensuring the integrity of Australia’s financial system.

Reporting Obligations for Businesses

Businesses providing designated services must adhere to strict reporting obligations to comply with AML/CTF regulations. These obligations include:

Transaction Reporting:

- Suspicious Matter Reports (SMRs): Reporting any transactions that appear suspicious or unusual.

- Threshold Transaction Reports (TTRs): Reporting transactions that exceed specific monetary thresholds.

Record-Keeping:

- Comprehensive Records: Maintaining detailed records of all transactions and customer information.

- Retention Period: Keeping records for a minimum period as stipulated by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) to facilitate audits and investigations.

AML/CTF Program:

- Risk Assessment: Conducting regular risk assessments to identify and mitigate potential AML/CTF risks.

- Internal Controls: Implementing robust internal controls and procedures to ensure compliance with AML/CTF obligations.

- Training and Awareness: Providing ongoing training to employees to recognise and respond to suspicious activities.

These reporting obligations enable AUSTRAC to effectively monitor financial activities, gather intelligence, and take necessary actions against businesses that fail to comply with AML/CTF regulations.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Reporting Entities and Geographical Link

Types of Reporting Entities

Reporting entities encompass a wide range of businesses and organisations that provide designated services. These typically include:

- Financial Services Providers:

- Digital Currency Exchange Providers: Facilitate the exchange of digital currencies like cryptocurrency for fiat money or other digital assets.

- Authorised Deposit-taking Institutions (ADIs): Such as banks, building societies, and credit unions, offering services like account and deposit taking, issuing debit cards, and accepting electronic funds transfer instructions (EFTIs).

- Bullion Service Providers:

- Bullion Dealers: Engage in the buying and selling of precious metals like gold, silver, platinum, or palladium, authenticated to a specified fineness.

- Gambling Activity Providers:

- Betting Agencies and Bookmakers: Offer betting accounts and services, exchange gaming chips or tokens, and handle the payout of winnings or prizes related to games or bets.

- Casinos, Pubs, Clubs, and Hotels: Typically provide electronic gaming machines, such as poker machines, as part of their gambling services.

- Other Reporting Entities:

- Financial Planners, Foreign Currency Exchange Providers, Investment Services Providers, and Life Insurance Companies: Offer various financial products and services that fall under the designated services regulated by AUSTRAC.

- Remittance Service Providers and Superannuation Fund Managers: Handle money transfers and manage retirement savings accounts, respectively.

Geographical Link Requirement

To qualify as a reporting entity under AUSTRAC’s AML/CTF framework, businesses must establish a geographical link to Australia. This link determines their AML/CTF obligations and is established by meeting one of the following criteria:

- Permanent Establishment in Australia:

- Providing a designated service at or through a permanent establishment located within Australia.

- Australian Residency with Foreign Establishment:

- Being a resident of Australia and providing a designated service at or through a permanent establishment located in a foreign country. This ensures that Australian residents operating internationally are still subject to AUSTRAC’s regulatory scope.

- Subsidiary of an Australian-Resident Company:

- Being a subsidiary of a company that is a resident of Australia and providing a designated service through a permanent establishment located in a foreign country. This extends AUSTRAC’s oversight to foreign subsidiaries of Australian entities.

Establishing a geographical link is crucial as it determines the extent of AML/CTF obligations a reporting entity must adhere to, ensuring that AUSTRAC can effectively oversee and regulate services that pose higher risks for money laundering and terrorism financing.

AUSTRAC’s New Powers Effective 2025

Enhanced Examination Powers

Under the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth), AUSTRAC is granted new examination powers enabling the CEO to request individuals and entities to provide information and documents related to AML/CTF compliance. These powers include:

- Written Notices: AUSTRAC can issue written notices requiring the production of specific documents or necessitating an appearance before an examiner to answer questions.

- Private Examinations: Examinations are to be conducted in private, ensuring confidentiality and integrity of the process.

- Legal Representation: Individuals subject to examinations may have their legal representatives present to assist during the process.

- Recording Examinations: AUSTRAC may record examinations to maintain accurate records and evidence.

Non-compliance with these examination powers can lead to severe penalties, including imprisonment of up to two years or fines of up to 100 penalty units (up to $33,000).

Expanded Information Gathering Capabilities

The Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth) also broadens AUSTRAC’s information gathering capabilities, allowing for proactive data collection beyond merely reporting suspicious transactions. Key aspects include:

- Proactive Requests: AUSTRAC can now seek information and documents from businesses and individuals without the prerequisite of a suspicious transaction report.

- Broader Scope: Notices can be issued to any person reasonably believed to possess relevant information, not restricted to reporting entities.

- Overcoming Privacy Barriers: AUSTRAC has the authority to authorise other regulators or entities to provide necessary information, thereby overcoming existing privacy and confidentiality constraints.

These enhanced capabilities significantly increase AUSTRAC’s role as Australia’s financial intelligence unit, enabling it to better detect and disrupt money laundering and terrorism financing activities.

Enforcement and Regulatory Priorities

Current Enforcement Focus

AUSTRAC continues to prioritise enforcement in high-risk sectors to effectively combat money laundering and terrorism financing. In 2024, AUSTRAC maintained its focus on the banking, gambling, and bullion sectors, conducting supervisory engagements with over 100 regulated businesses within these industries. Specific enforcement actions included:

- Civil Penalty Proceedings: AUSTRAC resolved multiple civil penalty enforcement proceedings against casinos and accepted enforceable undertakings from corporate bookmakers.

- Infringement Notices: Issued infringement notices to 19 reporting entities for failing to file annual compliance reports.

- Supervisory Engagements: Engaged with banks and financial services providers to ensure adherence to AML/CTF obligations.

These efforts highlight AUSTRAC’s commitment to maintaining rigorous oversight and ensuring compliance within the most vulnerable sectors.

Future Regulatory Priorities

Looking ahead to 2025, AUSTRAC plans to expand its regulatory activities to address emerging risks and the evolving financial landscape. The key sectors identified for future focus include:

- Digital Currency Exchanges and Crypto ATMs: Due to the rapid growth and associated AML/CTF compliance concerns, AUSTRAC aims to enhance oversight of digital currency exchanges and crypto ATMs.

- Payment Platforms: Increasing regulatory scrutiny on payment platforms to mitigate risks related to money laundering and terrorism financing.

- Bullion: Continued focus on the bullion sector to prevent its use in illicit financial activities.

- Non-Bank Lenders and Financiers: Addressing compliance variances and strengthening AML/CTF measures within non-bank financial entities.

These future priorities are driven by the need to keep pace with technological advancements and the expansion of financial services, ensuring that AUSTRAC can effectively detect and disrupt serious and organised crime within Australia’s financial system.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Compliance Requirements for Businesses

Developing an AML/CTF Program

Establishing a comprehensive AML/CTF program is essential for businesses to comply with AUSTRAC’s regulations. This program should include:

- Regular risk assessments to identify potential money laundering and terrorism financing risks specific to your operations

- Implementation of robust internal controls and procedures that enable effective risk mitigation

- Ongoing training and awareness programs for employees to recognise and respond to suspicious activities

By integrating these elements, the program fosters a culture of compliance within the organisation.

Reporting and Record-Keeping Obligations

Businesses must adhere to stringent reporting and record-keeping obligations to comply with AML/CTF regulations. This includes:

- Submitting Suspicious Matter Reports (SMRs) for any transactions that appear unusual or suspicious

- Filing Threshold Transaction Reports (TTRs) for transactions exceeding specified monetary limits

Furthermore, maintaining comprehensive records of all transactions and customer information is mandatory. These records must be retained for a required period to facilitate audits and investigations. In addition, businesses must ensure accurate and timely reporting to AUSTRAC, leveraging the enhanced information-gathering capabilities introduced by the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth).

Compliance Requirements for Businesses

AML/CTF Program

To comply with AML/CTF regulations, businesses must establish an Anti-Money Laundering and Counter-Terrorism Financing program. Key aspects of this requirement include:

- Enhancing board-level oversight of AML/CTF programs.

- Implementing robust monitoring systems as an essential measure.

- Preparing for potential AUSTRAC reviews and audits.

- Integrating elements within the program that foster a culture of compliance within the organisation.

Reporting and Record-Keeping Obligations

In addition to developing an AML/CTF program, businesses must adhere to stringent reporting and record-keeping obligations as mandated by AML/CTF regulations. Key aspects of these requirements include:

- Complying with reporting and record-keeping standards as set out by the regulations.

- Ensuring accurate and timely reporting to AUSTRAC, particularly by leveraging the enhanced information-gathering capabilities introduced by the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth).

- Recognising that failure to file an annual compliance report can result in penalties, as demonstrated by AUSTRAC issuing infringement notices to 19 reporting entities in 2024.

In 2025, AUSTRAC is encouraging reporting entities to focus on:

- Wider board oversight and involvement in managing money laundering and terrorism financing (ML/TF) risks.

- Greater active engagement in assessing entities’ ongoing ML/TF risk tolerance and supporting transitions to meet compliance capabilities and resourcing.

- Enhanced transaction monitoring and prioritising the investigation of high-risk transactions.

- Comprehensive and regular independent reviews of reporting entities’ AML/CTF programs.

Conclusion

AUSTRAC plays a crucial role in protecting Australia’s financial system by enforcing anti-money laundering and counter-terrorism financing obligations across designated services. With the enhanced powers granted by the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth), AUSTRAC is better equipped to detect and disrupt illicit financial activities, making compliance more important than ever for reporting entities.

To ensure your business meets all AML/CTF requirements and stays ahead of regulatory changes, contact our team today for legal advice. Leverage our specialised knowledge and proven solutions to navigate AUSTRAC’s regulatory landscape effectively and maintain the integrity of your financial operations.

Frequently Asked Questions

AUSTRAC regulates the financial, bullion, and gambling sectors, among others, due to their higher risks for money laundering and terrorism financing.

Any individual, business, or organisation providing designated services with a geographical link to Australia qualifies as a reporting entity.

Effective from January 2025, AUSTRAC can require individuals to produce documents or appear for examinations related to AML/CTF compliance.

Businesses must have a geographical connection to Australia, such as operating from an Australian establishment, to be subject to AUSTRAC’s AML/CTF obligations.

Penalties include significant fines and imprisonment for intentional or reckless non-compliance with AUSTRAC’s examination powers.

AUSTRAC can proactively seek information and documents from businesses and individuals, expanding its intelligence-gathering capabilities beyond suspicious transaction reports.

Businesses should develop comprehensive AML/CTF programs, conduct regular risk assessments, and ensure accurate reporting and record-keeping.

AUSTRAC plans to increase regulatory activities in sectors like digital currency exchanges, payment platforms, bullion, and non-bank lenders due to their rapid growth and compliance concerns.

Yes, AUSTRAC’s enhanced powers allow it to pursue individual accountability for breaches of AML/CTF laws, including issuing penalties and pursuing legal action against individuals involved in contraventions.