Introduction

Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regime is designed to prevent criminals from exploiting the financial system. This regime, which includes the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act), is a critical part of national efforts to combat financial crime and stop funds from reaching those involved in terrorism financing. Businesses play a vital role in this framework by identifying risks and helping to disrupt illegal activities, which protects both the community and the economy from harm.

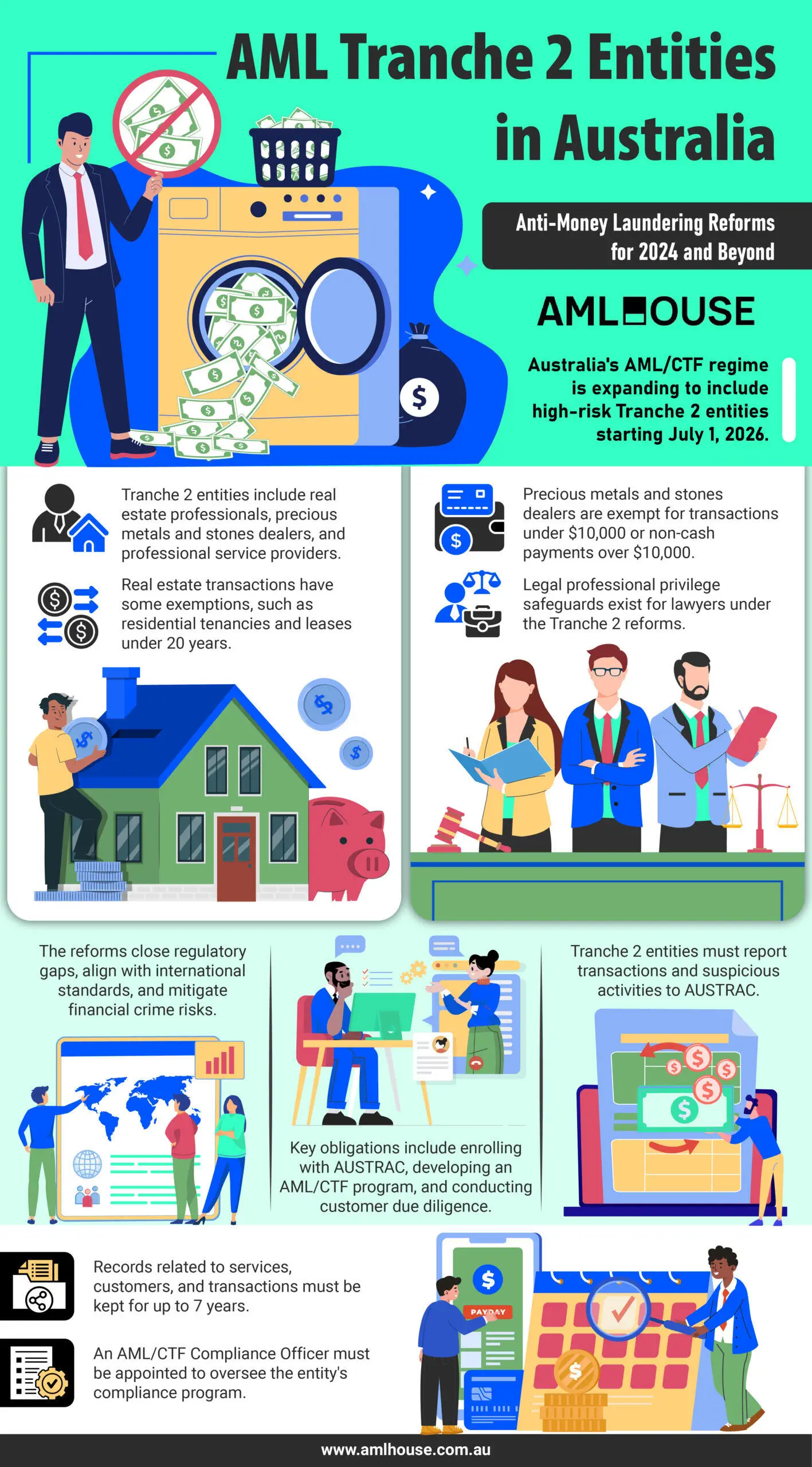

Recent reforms, through the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth) (Amendment Act), expand the scope of Australia’s AML/CTF regime to include certain high-risk businesses and professions, now known as ‘Tranche 2 entities’. These changes, set to commence on 1 July 2026, will bring approximately 70,000 additional businesses under AUSTRAC (Australian Transaction Reports and Analysis Centre) regulation, increasing the total number of reporting entities to 90,000. These reforms are designed to close regulatory gaps, align with international standards, and address the risks of money laundering and terrorism financing within these newly included sectors.

What are AML Tranche 2 Entities?

AML Tranche 2 entities refer to certain high-risk businesses and professions that have been newly brought under AUSTRAC regulation as a result of the Amendment Act. Previously, these entities were not subject to the same regulatory scrutiny, but they are now recognised as more vulnerable to exploitation for money laundering and terrorism financing. The primary categories of Tranche 2 entities include:

- Real Estate Professionals and Developers

- Dealers in Precious Metals and Stones

- Professional Service Providers

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Key Businesses Categories Now Under AML Tranche 2 Regulation

| Category | Inclusions | Exclusions / Exemptions |

|---|---|---|

| Real Estate Professionals & Developers | – Real Estate Agents: Those brokering real estate sales, purchases, or transfers on behalf of clients. – Real Estate Developers: Selling/transferring real estate directly. | – Residential tenancy agreements – Leasehold interests ≤20 years (excluding extension options) – Property management services – Leasing of commercial real estate – Auctioneer services (unless tied to a real estate sale by seller’s agent) |

| Dealers in Precious Metals & Stones | – Precious Metals: Gold, silver, platinum, iridium, osmium, palladium, rhodium, ruthenium, or alloys with ≥2% of these metals. – Precious Stones: Gem-quality materials (e.g., beryl, corundum, diamonds, garnet, jadeite jade, opal, pearl, topaz). – Precious Products: Jewellery, watches, personal adornments, and goldsmith/silversmith wares containing precious metals or stones. | – Transactions below $10,000. – Transactions above $10,000 if conducted via non-cash payments (e.g., debit/credit card, BPAY, PayPal). – Businesses opting out of accepting physical currency/virtual assets for transactions ≥$10,000. |

| Professional Services Providers | – Lawyers – Accountants – Insolvency & restructuring practitioners – Consultants | – Legal Professional Privilege (LPP) safeguards: – Amendment Act does not override LPP. – No requirement to file suspicious matter reports if LPP applies. – LPP claim can be submitted via an LPP Form to AUSTRAC CEO. – Barristers acting under solicitor’s instructions are not subject to LPP restrictions. |

Why are Tranche 2 AML/CTF Reforms Necessary?

The reforms affecting Tranche 2 entities are critical for strengthening Australia’s overall AML/CTF framework and ensuring alignment with international standards. Key reasons for these reforms include:

- Closing Regulatory Gaps: By extending regulatory oversight to previously unregulated high-risk sectors, the reforms help plug gaps in the financial system that criminals might exploit.

- Alignment with International Standards: These measures ensure that Australian law adheres to the guidance established by international bodies such as the Financial Action Task Force (FATF), reinforcing the global fight against financial crime.

- Mitigating Risk: Incorporating Tranche 2 entities under the AML/CTF regime is intended to reduce vulnerabilities in sectors that could be exploited for money laundering, terrorism financing, and proliferation financing, thus elevating the effectiveness of Australia’s financial crime prevention efforts.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Key AML/CTF Obligations for Australian Tranche 2 Entities

Tranche 2 entities are subject to a comprehensive set of AML/CTF obligations. These requirements are designed to mitigate risks associated with money laundering, terrorism financing, and proliferation financing. Below is an overview of the key obligations that these entities must adhere to:

Enrolment with AUSTRAC and AML/CTF Program

- AUSTRAC Enrolment: Businesses providing designated services must enrol with AUSTRAC before commencement.

- Development of AML/CTF Policies:

- Develop and maintain tailored AML/CTF policies specific to business operations.

- Ensure these policies are in place before offering designated services.

- Conduct a thorough risk assessment to identify potential money laundering, terrorism financing, and proliferation financing risks.

Customer Due Diligence and KYC Procedures

- Initial Customer Due Diligence (CDD):

- Collect and verify customer identity.

- Assign a risk rating based on the gathered information.

- Ongoing Customer Due Diligence:

- Continuously update Know Your Customer (KYC) information.

- Monitor transactions and customer behaviour for any unusual or suspicious activities.

- Enhanced Due Diligence: Apply additional scrutiny for high-risk customers, such as politically exposed persons.

Reporting Transactions and Suspicious Activity to AUSTRAC

- Suspicious Matter Reports (SMRs): Report any suspicions of illicit activities by submitting SMRs to AUSTRAC.

- Threshold Transaction Reports: Submit reports for transactions that exceed predefined thresholds.

- Additional Reporting: Extend reporting obligations to services such as international value transfers.

Record Keeping Requirements

- Maintenance of Records:

- Retain records related to designated services, KYC information, and transaction details.

- Maintain these records for up to seven years after the conclusion of the business relationship or transaction.

Appointing an AML/CTF Compliance Officer

Appoint an AML/CTF Compliance Officer responsible for the following:

- Overseeing the operation of the entity’s AML/CTF policies and procedures.

- Ensuring the AML/CTF program is regularly reviewed and updated to reflect changes in legislation, AUSTRAC guidance, and the business’s risk profile.

- Acting as a point of contact for AUSTRAC and managing AML/CTF related inquiries and reporting.

- Providing ongoing training and support to staff on AML/CTF compliance matters.

Conclusion

The AML Tranche 2 reforms represent a significant expansion of Australia’s AML/CTF regime. These reforms, driven by the Amendment Act, are crucial for closing regulatory gaps and aligning Australia with international standards in combating financial crime, money laundering and terrorism financing.

To ensure your organisation is ready for these changes, contact AML House today to explore our tailored compliance solutions and leverage our unparalleled expertise in navigating the complexities of the evolving AML/CTF landscape.

Frequently Asked Questions

AML/CTF obligations for Tranche 2 entities commence on 1 July 2026. Businesses categorised as Tranche 2 entities must comply with the AML/CTF Act from this date. This allows businesses time to prepare and implement necessary compliance measures.

Tranche 2 entities include real estate professionals and developers, dealers in precious metals and stones, and professional service providers. These categories are considered high-risk for money laundering and terrorism financing. This includes businesses like real estate agents, precious metal dealers, lawyers, accountants, and insolvency practitioners.

The Amendment Act reforms and expands Australia’s AML/CTF regime to include high-risk services. It aims to strengthen Australia’s framework against money laundering, terrorism financing, and proliferation financing. It also aligns Australian law with international standards.

Key obligations include enrolling with AUSTRAC, developing AML/CTF policies, appointing a compliance officer, conducting due diligence, reporting suspicious activities, and record-keeping. These obligations are crucial for identifying, detecting, and mitigating risks. Businesses must understand and implement these measures.

Yes, AUSTRAC will provide guidance and educational materials to support Tranche 2 entities. This support will help both current and new regulated entities understand their obligations. AUSTRAC is also developing AML/CTF starter program kits for small businesses.

Designated services define the scope of entities subject to the AML/CTF regime. The Amendment Act uses ‘designated services’ to specify regulated activities. Any entity providing a designated service with a geographical connection to Australia will be regulated.

LPP is protected, ensuring the Amendment Act doesn’t override it. Lawyers are exempt from reporting information subject to LPP. If claiming LPP, lawyers must submit a prescribed LPP form to AUSTRAC CEO.

Businesses should confirm if they provide ‘designated services’ and are classified as Tranche 2 entities. If so, they should develop a risk assessment, AML/CTF policies, due diligence processes, explore technology solutions, appoint a compliance officer, and develop staff training. These steps will help establish a robust compliance framework.