Introduction

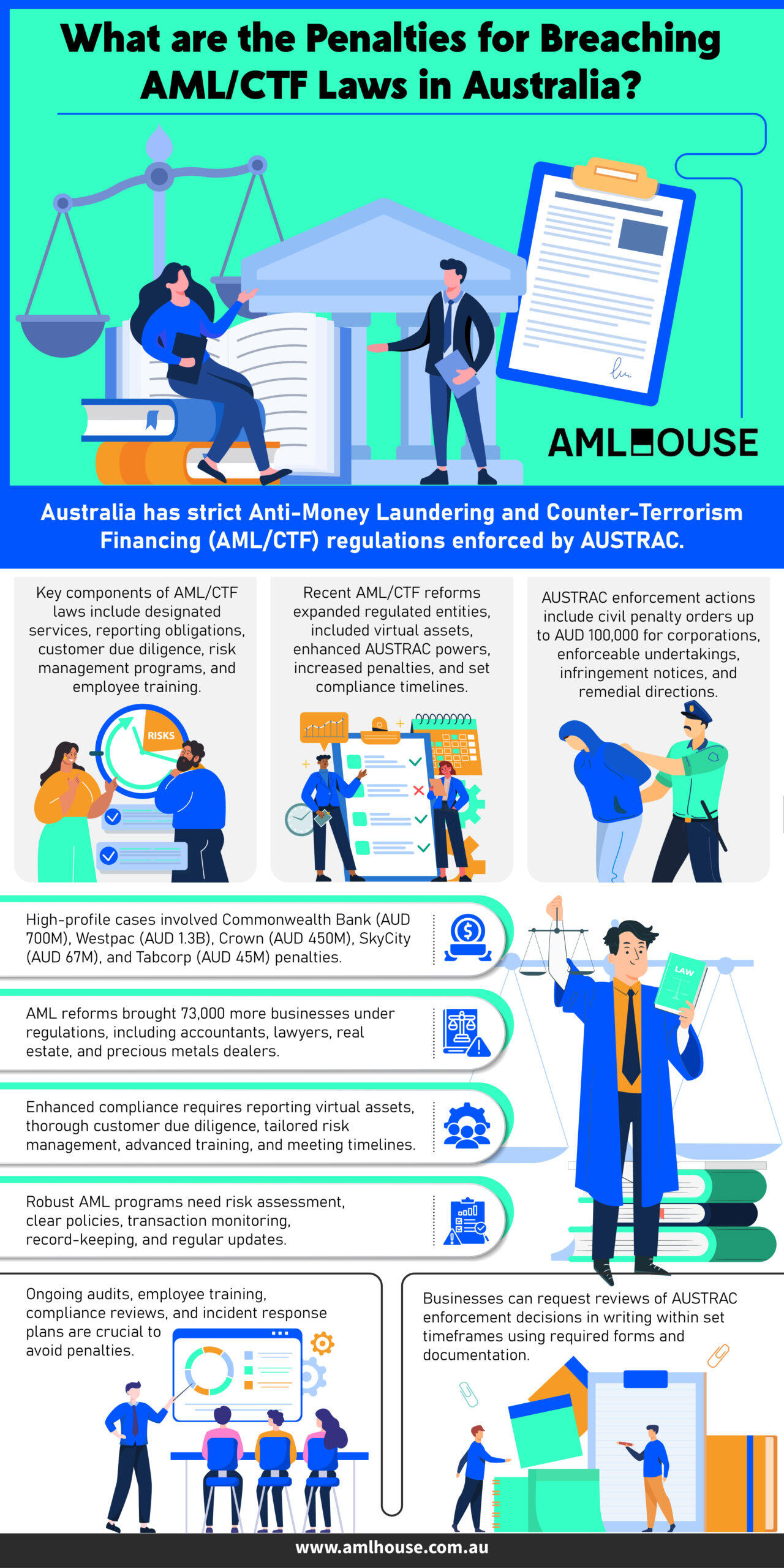

Australia’s stringent Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations impose significant penalties for non-compliance, underscoring the importance of adherence for businesses.

Companies that fail to meet these obligations can face hefty fines and enforcement actions from the Australian Transaction Reports and Analysis Centre (AUSTRAC), aimed at safeguarding the financial system and preventing criminal activities.

Overview of AML Regulations in Australia

AML/CTF regulations in Australia form a comprehensive framework designed to prevent and detect financial crimes. These regulations are primarily enforced by the AUSTRAC, which oversees compliance and implements measures to mitigate risks associated with money laundering and terrorism financing.

Key Components of AML/CTF Laws

The AML/CTF laws in Australia encompass several critical components that reporting entities must adhere to. These include:

- Designated Services: Certain services are classified as designated, requiring businesses to comply with AML/CTF obligations. These services include activities performed by accountants, lawyers, real estate agents, and digital currency exchange providers.

- Reporting Obligations: Businesses must report specific transactions to AUSTRAC, such as large cash transactions and suspicious matters. This reporting helps AUSTRAC monitor and analyse financial activities to identify potential illicit behaviour.

- Customer Due Diligence (CDD): Entities are required to conduct thorough due diligence on their customers to verify their identities and assess the risk of money laundering or terrorism financing. This process includes gathering and verifying information before establishing a business relationship.

- Risk Management Programs: Organisations must develop and maintain robust AML/CTF programs tailored to their specific risk profiles. These programs should include policies, procedures, and controls to manage and mitigate identified risks effectively.

- Employee Training: Regular training programs are essential to ensure that staff are aware of their AML/CTF obligations and can recognise and respond to suspicious activities appropriately.

Recent AML/CTF Reforms

Recent reforms to the AML/CTF regulations have significantly expanded the scope of compliance requirements for businesses in Australia. Notable changes include:

- Expansion of Regulated Entities: The AML/CTF Amendment Act 2024 (Cth) broadens the range of businesses subject to AML/CTF laws, bringing in previously unregulated sectors such as trust and company service providers, insolvency practitioners, and dealers in precious metals, jewels, and stones.

- Inclusion of Virtual Assets: The reforms extend AML/CTF obligations to a wider array of virtual assets, including non-fungible tokens (NFTs) and other fungible tokens, reflecting the growing importance of digital currencies in the financial landscape.

- Enhanced Powers for AUSTRAC: AUSTRAC has been granted new authorities to compel the production of information and conduct examinations of reporting entities. These powers enable more effective oversight and enforcement of AML/CTF compliance.

- Increased Penalties for Non-Compliance: The amendments introduce harsher penalties for breaches of AML/CTF laws, including substantial fines and potential imprisonment for serious offences. Corporations can face fines up to 100,000 penalty units, while individuals may be subject to fines up to 20,000 penalty units.

- Timeline for Compliance: Businesses must comply with the new AML/CTF regime by 1 July 2026, except for tipping off reforms, which commence in March 2025. This timeline allows organisations to adjust their compliance programs accordingly.

These reforms aim to align Australia’s AML/CTF framework with international standards, enhancing the country’s ability to combat financial crimes effectively.

Types of Enforcement Actions by AUSTRAC

Civil Penalty Orders

AUSTRAC can apply for a civil penalty order from the Federal Court of Australia. If successful, the Court may order the offending entity to pay a penalty to the Commonwealth. The maximum penalty can be up to 20,000 penalty units for individuals or up to 100,000 penalty units for corporations. Penalty units are calculated based on the value set at the time of the offence.

Enforceable Undertakings

Businesses may offer an enforceable undertaking to the AUSTRAC CEO, outlining how they will comply with AML/CTF laws. These undertakings include specific actions that the business commits to take or refrain from. Failure to adhere to the terms of an enforceable undertaking can result in AUSTRAC applying to the Federal Court of Australia to enforce its terms.

Infringement Notices

AUSTRAC can issue infringement notices for breaches of specific AML/CTF obligations, such as know your customer (KYC) procedures, reporting requirements, enrolment, and record-keeping. These notices may be made public and serve as a formal recognition of non-compliance.

Remedial Directions

Remedial directions are written instructions issued by AUSTRAC, requiring businesses to take specific actions to comply with sections of the AML/CTF Act 2006 (Cth). These directions aim to prevent future breaches and ensure ongoing compliance. They can include requirements to submit reports or implement new procedures.

High-Profile Enforcement Cases

Commonwealth Bank of Australia (AUD 700 Million)

The Commonwealth Bank of Australia (CBA) faced significant penalties for widespread AML/CTF breaches. The bank was ordered to pay AUD 700 million after it failed to report over 53,000 cash transactions exceeding the designated threshold. This case marks one of the largest civil penalties in Australian corporate history, underscoring the critical importance of compliance with AML/CTF regulations.

Westpac Banking Corporation (AUD 1.3 Billion)

Westpac Banking Corporation received a hefty penalty of AUD 1.3 billion due to serious AML/CTF compliance failures. AUSTRAC identified 23 million breaches, including the failure to report international fund transfers and inadequate due diligence on high-risk customers. These breaches significantly contributed to the gravity of the penalty imposed.

Crown Melbourne and Crown Perth (AUD 450 Million)

Crown Melbourne and Crown Perth were subjected to an AUD 450 million penalty for their systemic AML/CTF non-compliance. AUSTRAC discovered failures in managing high-risk customers and inadequate systems to prevent money laundering activities. The lack of effective oversight and control measures led to substantial regulatory action against both entities.

SkyCity Adelaide (AUD 67 Million)

SkyCity Adelaide was penalised AUD 67 million following AUSTRAC’s investigation into its AML/CTF practices. The investigation revealed weaknesses in SkyCity’s high-risk channels and insufficient due diligence related to a large number of high-risk customers. These failures highlighted poor governance and oversight within the company.

Tabcorp (AUD 45 Million)

Tabcorp was fined AUD 45 million for breaches of AML/CTF laws. The company failed to lodge over 100 suspicious matter reports and lacked adequate risk management systems to address money laundering risks. This enforcement action served as a notable example of AUSTRAC’s commitment to stringent compliance in high-risk industries.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

New AML Reforms and Their Impact

Expanded Scope of Regulated Entities

The recent AML/CTF reforms have significantly widened the range of businesses subject to compliance obligations. Approximately 73,000 more businesses are now required to adhere to AML/CTF regulations, bringing previously unregulated sectors under the regulatory umbrella. The reforms have specifically targeted the following designated services:

- Accountants: Professionals involved in financial planning and tax services must now implement AML/CTF measures.

- Lawyers: Legal practitioners providing advisory services are required to comply with the updated regulations.

- Real Estate Agents and Dealers: Those engaged in property transactions must adhere to AML/CTF obligations.

- Conveyancers: Specialists in property law must ensure compliance with AML/CTF standards.

- Trust and Company Service Providers: Including custodial service providers, these entities must now implement robust AML/CTF frameworks.

- Insolvency and Restructuring Practitioners: Professionals assisting in business restructuring must comply with the new AML/CTF requirements.

- Dealers in Precious Metals, Jewels, and Stones: Businesses trading in high-value commodities are now subject to stricter AML/CTF regulations.

The expansion aims to close loopholes and ensure comprehensive coverage of sectors vulnerable to money laundering and terrorism financing activities.

Enhanced Compliance Requirements

The AML/CTF reforms introduce several new compliance obligations designed to strengthen the regulatory framework and mitigate financial crimes. Key enhancements include:

- Reporting Obligations: Businesses must now report a broader range of transactions, including those involving virtual assets like NFTs and other fungible tokens. This extension ensures that emerging digital currencies are monitored effectively.

- Customer Due Diligence: Enhanced CDD procedures require more thorough verification of customer identities and risk assessments. Businesses must gather and validate additional information to assess the potential risks of money laundering or terrorism financing.

- Risk Management Programs: Organisations must develop and maintain comprehensive AML/CTF programs tailored to their specific risk profiles. These programs should include updated policies, procedures, and controls to manage and mitigate identified risks effectively.

- Employee Training: Regular and advanced training programs are mandated to ensure that staff are knowledgeable about the latest AML/CTF obligations and can identify and respond to suspicious activities appropriately.

- Virtual Asset Monitoring: With the inclusion of virtual assets, businesses must implement specialised monitoring systems to track and report transactions involving digital currencies, ensuring that these new financial instruments do not become avenues for illicit activities.

- Compliance Timelines: All businesses must achieve full compliance with the new AML/CTF regime by 1 July 2026, except for tipping off reforms, which commence in March 2025. These timelines provide organisations with adequate time to update their compliance programs and systems.

These enhanced requirements are designed to align Australia’s AML/CTF framework with international standards, thereby improving the country’s ability to detect and prevent financial crimes effectively.

Compliance Strategies to Avoid Penalties

Implementing Robust AML Programs

Developing a comprehensive AML/CTF program is essential for ensuring compliance and mitigating risks associated with financial crimes. A robust AML program should include the following elements:

- Risk Assessment: Conduct thorough assessments to identify and evaluate potential money laundering and terrorism financing risks specific to your business operations.

- Policies and Procedures: Establish clear policies and procedures that outline how your organisation will manage and mitigate identified risks.

- Customer Due Diligence: Implement stringent CDD measures to verify the identity of clients and assess their risk profiles.

- Transaction Monitoring: Utilise advanced systems to monitor transactions for suspicious activities, ensuring timely detection and reporting.

- Record-Keeping: Maintain detailed records of all transactions and compliance activities to provide transparency and facilitate audits.

Regularly updating your AML/CTF program to reflect changes in regulations and emerging threats is crucial for ongoing compliance.

Regular Audits and Training

Ongoing audits and continuous training are vital components of an effective AML/CTF compliance strategy. These practices help maintain high standards of compliance and adapt to evolving regulatory requirements.

- Regular Audits: Conduct periodic internal and external audits to evaluate the effectiveness of your AML/CTF program. Audits help identify weaknesses and areas for improvement, ensuring that your compliance measures remain robust.

- Employee Training: Provide comprehensive training programs for all employees to enhance their understanding of AML/CTF obligations. Training should cover how to recognise and report suspicious activities, ensuring that staff are well-equipped to uphold compliance standards.

- Compliance Reviews: Implement routine reviews of your compliance policies and procedures to ensure they are up-to-date and aligned with current laws and regulations.

- Incident Response: Develop a clear incident response plan to address any breaches or compliance failures promptly and effectively, minimising potential penalties and reputational damage.

By integrating regular audits and training into your compliance strategy, your organisation can proactively address compliance challenges and avoid significant penalties.

Get Your Free Initial Consultation

Request a Free Consultation with one of our experienced AML Lawyers today.

Legal Recourse and Review of AUSTRAC Decisions

Applying for Decision Review

Businesses can request a review of AUSTRAC’s enforcement decisions by following these steps:

- Submit an Application in Writing

You must apply in writing for a review within 30 days of being notified of the decision. - Complete the Required Application Form

Ensure your application is completed using the specified form provided by AUSTRAC. - Provide Supporting Documentation

Include all relevant information and evidence that supports your request for a review. - Await AUSTRAC’s Response

After submission, AUSTRAC will reassess the decision based on the information provided in your application.

Suspension Decision Review

If your registration has been suspended by AUSTRAC, you can apply for a review by following these steps:

- Apply in Writing Promptly

Submit your application for a review within 14 days of receiving the suspension notice. - Use the Appropriate Review Form

Complete the designated form required for suspension reviews. - Detail Your Reasons for Review

Clearly outline the reasons why you believe the suspension should be reconsidered, providing any necessary evidence or explanations. - Follow Through with Additional Requirements

If AUSTRAC requests further information or documentation, ensure timely and thorough compliance to facilitate the review process.

Conclusion

Non-compliance with Australia’s AML/CTF regulations can lead to severe financial penalties and legal consequences. The recent AML/CTF reforms have expanded the scope of regulated entities and heightened compliance obligations, further emphasising the critical need for robust AML/CTF programs within organisations.

To safeguard your business from substantial penalties and ensure full compliance with AML/CTF regulations, it is essential to implement comprehensive compliance strategies tailored to your specific risk profile. Contact our expert legal team today to assess and enhance your AML/CTF compliance framework, leveraging our extensive knowledge and experience to protect your organisation from non-compliance risks.

Frequently Asked Questions

Corporations can face fines up to 100,000 penalty units, while individuals may be fined up to 20,000 penalty units for AML/CTF breaches. These penalties reflect the severity of non-compliance and aim to enforce adherence to AML/CTF regulations.

Yes, AUSTRAC can impose imprisonment for serious AML/CTF offences, such as tipping off or recklessly failing to comply with examination powers. Individuals may face up to two years of imprisonment.

AUSTRAC calculates civil penalties by multiplying the number of penalty units associated with an offence by the value of one penalty unit at the time of the breach. For example, a body corporate breach after 1 July 2023 could result in a penalty of up to 100,000 penalty units.

Businesses should implement robust AML/CTF programs that include risk assessments, customer due diligence, transaction monitoring, employee training, and regular audits. These measures help identify and mitigate money laundering and terrorism financing risks effectively.

Businesses can appeal AUSTRAC’s enforcement actions by applying for a decision review within the specified timeframe: 30 days for decisions that are not suspensions, and 14 days for suspension decisions. This involves submitting a written application with supporting documentation to AUSTRAC.

High-profile AML/CTF enforcement cases include the Commonwealth Bank of Australia fined AUD 700 million for over 53,000 breaches and Westpac Banking Corporation ordered to pay AUD 1.3 billion due to 23 million breaches.

Recent AML/CTF reforms expand the scope of regulated entities, bringing approximately 73,000 more businesses under AML/CTF laws, and include the inclusion of virtual assets like NFTs. Additionally, these reforms grant AUSTRAC enhanced powers and increase penalties for non-compliance.

While most industries must comply with AML/CTF obligations, certain sectors like remittance service providers and digital currency exchange providers may face specific registration actions if they pose unacceptable risks. There are no broad exemptions, and businesses must adhere to AML/CTF laws relevant to their designated services.

AML/CTF compliance programs should be reviewed and updated regularly, at least annually, and whenever there are significant changes to business operations or the regulatory environment. Regular audits and ongoing employee training are also essential to maintain compliance.